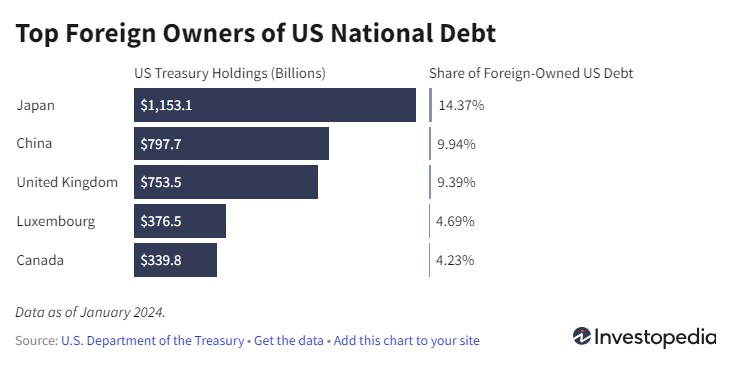

Japan stays the most important holder of the US as of Could 2024, holding $1.186 trillion in Treasury securities and 14.7% of all foreign-owned US debt. China has been promoting off its holdings in an pressing effort to distance itself from the US, however is at the moment the second-largest holder of US debt, carrying about $767.4 billion as of March 2024. I largely discuss China’s debt holdings as a result of they have been the highest purchaser of US debt earlier than the political panorama modified.

Inside a mere 4 years, China offered off 30% of its holdings or over $250 billion in US debt. This assisted the yuan basically as China was ready to make use of the change price to purchase yuan when the foreign money depreciated. China appeared to be aiding Trump years in the past in reducing the greenback to ease commerce frictions. That’s now not the case right here as the US enacted financial warfare towards Russia, pushing it off SWIFT, confiscating personal belongings, and implementing numerous sanctions. America did all of this to Russia with out formally being at battle. Who’s to say the identical wouldn’t occur to China below the excuse of Taiwan?

Damaging rates of interest have been an enormous mistake for Japan. In contrast to China, Japan goals to strengthen ties with the US. The nation drastically elevated its holdings of US debt in 2023. US bonds appear safter than the low-yield returns supplied domestically in Japan. Funds are shifting out of Japan and into the US. They see US debt as comparatively protected as they’ve a robust alliance with the US and the yield are merely increased.

The recommendation I used to supply to Japan to assist cut back the commerce friction was to purchase gold in New York and promote it in London. The commerce numbers might care much less concerning the product really being exported. It’s going to cut back the commerce deficit and make US exports seem to rise. It’s simply an accounting ploy. Likewise, the booming exports of China have been being manipulated by Chinese language corporations borrowing {dollars} in Hong Kong after which bringing that cash into China and accumulating 3 times that value in curiosity. Headlines are at all times made on the numbers with out understanding the accounting.

I obtained the query of why I discuss China’s purchases and never Japan’s. Once more, I communicate primarily of China’s offloading of US debt as a result of that may be a bigger challenge. China has not slowed its tempo of offloading US Treasuries and this turns into an issue because the debt disaster will come to a head when there may be merely nobody keen or in a position to purchase US authorities debt. The Fed desperately wanted China’s participation as its plan was to roll over its money owed perpetually. They merely can not repay $34+ trillion and counting. Japan and the UK can not compensate for the lack of Chinese language purchases.