There’s a purpose voters are listening to extra in regards to the little one tax credit score throughout this presidential marketing campaign, with each Republican and Democratic candidates voicing assist for its enlargement.

Giving households with youngsters a break on their taxes is a well-liked and efficient coverage that reduces poverty and helps dad and mom afford primary requirements akin to groceries and little one care. The kid tax credit score is at the moment capped at $2,000 a yr per little one and set to run out in 2025.

Vice President Kamala Harris desires to revive it to its pandemic-era degree of as much as $3,600 per little one and add an extra $6,000 credit score for households with newborns. Former President Trump has supplied solely imprecise feedback of assist for the kid tax credit score, although his vice presidential operating mate, Ohio Sen. JD Vance, mentioned he desires to extend it to $5,000.

However we’re not placing a lot inventory in pledges from Republicans to battle for working households. Vance, who has disingenuously tried to label Democrats “anti-family and anti-kid,” didn’t even present as much as vote for a modest enlargement of the kid tax credit score that his fellow Senate Republicans defeated Aug. 1. And Trump, whose tax insurance policies whereas in workplace largely favored the rich, is a serial liar who will say virtually something to regain energy.

That’s too dangerous. As a result of whoever controls the White Home subsequent yr ought to comply with by means of with a everlasting enlargement of a coverage that’s confirmed to ease monetary stress for households and elevate youngsters out of poverty.

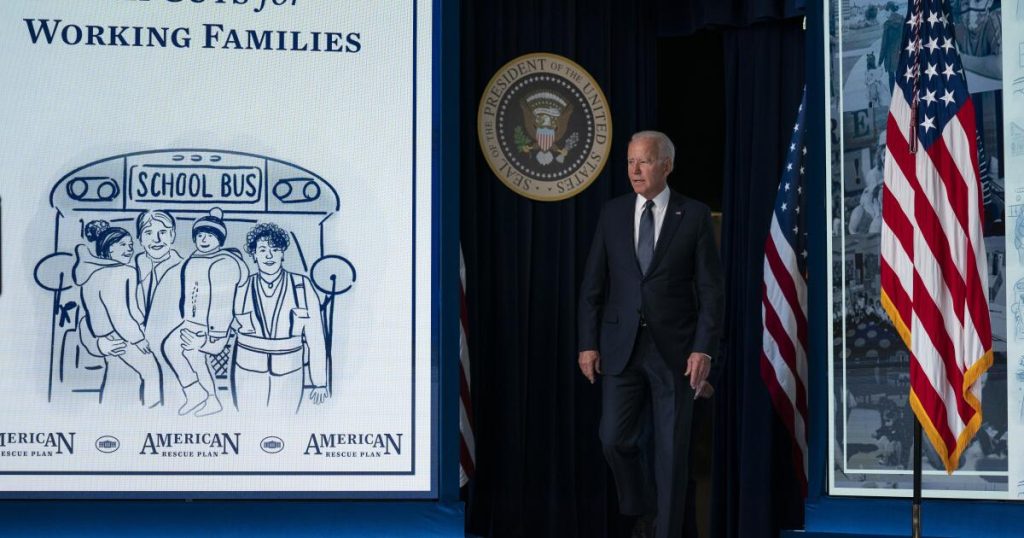

The kid tax credit score was first enacted in 1997 beneath President Clinton and has been expanded a number of instances by each Democratic and Republican presidents. However essentially the most dramatic enchancment got here beneath President Biden along with his signing of the 2021 American Rescue Plan. The regulation, which acquired no Republican votes, elevated the kid tax credit score, made it absolutely refundable, paid it out in month-to-month deposits of as much as $300 per little one into households’ financial institution accounts and prolonged the total advantages to low-income youngsters who had beforehand acquired much less as a result of their households earned too little.

These enhancements introduced speedy, life-changing advantages. Baby poverty and meals insecurity plummeted. Households reported feeling much less harassed about cash and their checking account balances rose, in keeping with researchers. The month-to-month deposits supplied a predictable supply of earnings for practically 40 million households, and left it to folks to resolve how finest to make use of the cash. Researchers at Columbia College’s Heart on Poverty and Social Coverage discovered they spent it totally on necessities akin to meals, little one care and housing.

However Congress allowed it to run out after six months, and Republicans have since blocked efforts to increase or restore it. A lot for being pro-family.

It’s encouraging that Harris has made reviving and increasing Biden’s pandemic-era little one tax credit score one among her first main financial coverage proposals, pitching it as necessary monetary reduction for working- and middle-class households. Her operating mate, Minnesota Gov. Tim Walz, has delivered related advantages for households in his state by means of a beneficiant, $1,750-per-child tax credit score that took impact final yr.

Vance’s curiosity in increasing the kid tax credit score appears motivated by a wholly completely different philosophy, together with his fringe views on girls’s function in society, his pro-natalist fascination with rising the nation’s beginning price and his outlandish suggestion to offer dad and mom with younger youngsters further votes and cut back the electoral energy of childless individuals. Together with rising the kid tax credit score, Vance desires to increase the advantages to the wealthiest households. It’s one other reflection of a Republican Celebration that’s all the time looking for the wealthy.

For instance, it’s true that Trump elevated the kid tax credit score from $1,000 to $2,000 as a part of his 2017 tax cuts that slashed tax charges for the rich and firms. Nevertheless it was structured in a manner that delivered a lot of the advantages to high-income households.

A married couple incomes $400,000 with two youngsters acquired a brand new $4,000 tax break whereas a single guardian of two making minimal wage noticed their tax break enhance by solely $75. That’s as a result of it prolonged the total tax credit score to higher-income households however didn’t make it absolutely refundable, leaving poor households who don’t owe a lot earnings tax with solely a token enchancment, in keeping with an evaluation by the Heart on Funds and Coverage Priorities assume tank.

Households deserve extra assist when rising costs for housing, meals and different necessities are inflicting plenty of monetary insecurity. Strengthening the kid tax credit score is a robust and confirmed answer.

It’s a very good signal that each the Republican and Democratic candidates are speaking about doing extra to assist households with youngsters. The well-being of youngsters is in all of society’s finest curiosity and shouldn’t be a partisan concern. However we predict marketing campaign pledges are extra convincing coming from candidates with the monitor report to again them up. And when politicians declare they’re pro-family, don’t simply take heed to what they are saying, take a look at what they do.