Heads up: a few of the hyperlinks on this website are affiliate hyperlinks. In the event you click on and make a reserving or buy, I’ll make a fee (at no further price to you). I companion with firms I personally use and the $$ goes in the direction of creating extra superior, free journey content material.

I don’t find out about you however I believe metallic bank cards are fairly attractive and positively give off that luxe, high-end vibe. Put a metallic card down at a restaurant and somebody is sure to ask you about the place you bought it once they really feel the load of it of their hand. Proudly owning one is a little bit of a press release piece, similar to jewellery, they usually usually include all types of perks.

One firm providing a metallic card choice is Curve, a UK FinTech firm that was based in 2015 by entrepreneur Shachar Bialick. I truly signed up for Curve in 2016 once they launched a beta model for entrepreneurs, freelancers and different movers and makers who’re self-employed, and journey extensively. The primary motive I signed up was as a result of I journey so much and this card prices no overseas transaction charges – a characteristic that was onerous to return by on the time.

Curve finally launched a number of tiers of playing cards, so extra lately I used to be curious to check out Curve Steel, which is a metallic card that comes with a bunch of options akin to worldwide journey insurance coverage, cell phone insurance coverage, LoungeKey airport lounge entry and rental automobile collision waver insurance coverage.

It’s necessary to notice that Curve isn’t a financial institution, neither is it a bank card. Curve connects all of your debit and bank cards into one so it’s the one card you ever want to hold. Merely carry the Curve Mastercard in your pockets and go away the remainder at residence. You may select which card to make use of on the checkout with the Curve cellular app, or it’ll robotically choose your final used card.

Learn on for my full Curve card evaluate:

Signal-up course of & establishing

To enroll you merely obtain the Curve app for iOS or Android and select which Curve card you need to order. The cardboard arrives in round 3-5 working days. Within the app you possibly can add your playing cards to Curve by utilizing your telephone digital camera or coming into manually.

As soon as the cardboard arrives, you simply have to go to the “Account” tab and faucet “Activate your card”. You’ll be requested to enter the final 4 digits of your Curve card, and it’s able to go.

Curve Steel Card Unboxing

The Curve Steel card is available in 3 colours – pink, navy and a rose gold colour. I selected the navy blue one. It arrived in a classy field that slides out and reads “Welcome to metallic, the brand new black.” It might truly be good if they’d a black or platinum choice for the cardboard however the navy seems to be very good. The cardboard weighs 18g, so it has a pleasant weighty really feel in contrast to plastic playing cards.

Curve Card Options

All Curve playing cards, regardless of which tier, have the next options:

- Mix your playing cards in a single

- Works with Google Pay, Samsung Pay and Apple Pay

- iOS and Android App with financial institution degree safety

- Curve Buyer Safety as much as £100,000

There are then further options relying on the tier you get.

Curve Card Tiers

- Curve Blue is free.

- Curve Black is £9.99 per 30 days with an upgraded providing

- Curve Steel comes at £14.99 per 30 days

Curve Blue – Permits entry to truthful overseas alternate charges as much as the restrict of £500 per 30 days. You additionally get fee-free overseas ATM withdrawals as much as the max of £200 per 30 days.

Curve Black – Provides you entry to limitless truthful overseas alternate charges and fee-free overseas ATM withdrawals as much as the restrict of £400 per 30 days. You may as well select to earn 1% cashback at 3 retailers (which you choose from their checklist).

Curve Steel – Provides you entry to limitless truthful overseas alternate charges and fee-free overseas ATM withdrawals as much as a max of £600 per 30 days. You may as well select to earn 1% cashback at 6 retailers (which you choose from their checklist). As well as you get worldwide journey insurance coverage, cell phone insurance coverage, LoungeKey entry and rental automobile collision waiver insurance coverage.

Utilizing the app

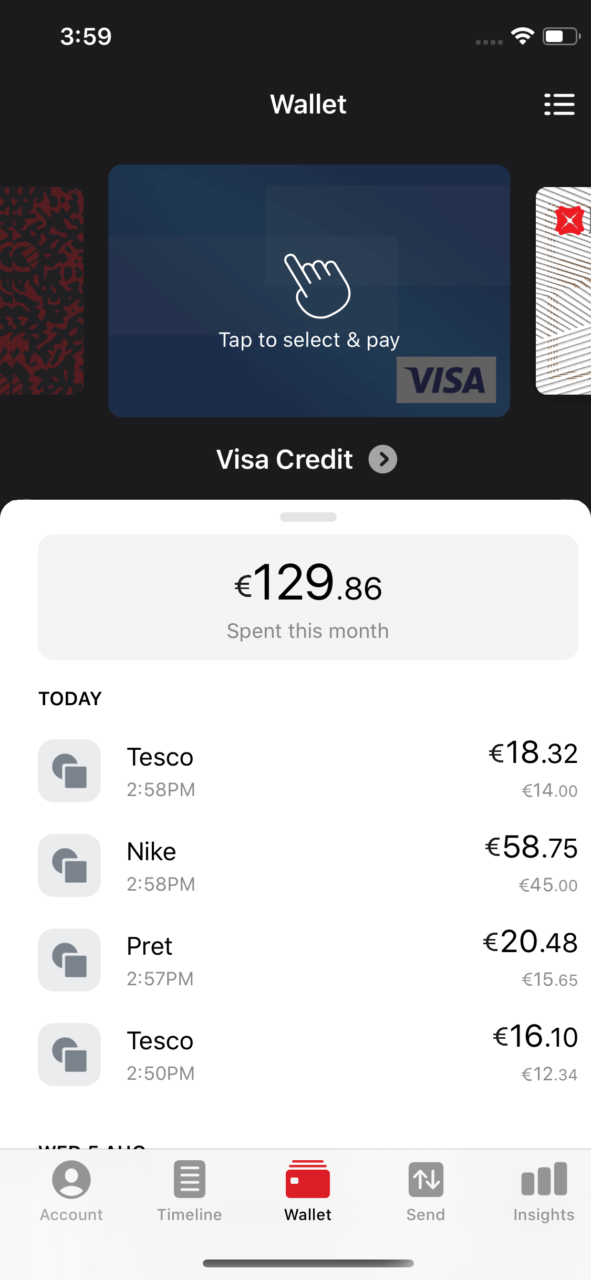

Once you come to pay for one thing at a checkout, you possibly can merely swipe by means of your digital pockets within the app and choose the cardboard you’d like to make use of. Then you definately use your Curve card similar to a traditional card, normally by inserting your card with Chip and Pin or utilizing Contactless.

Actual-time transaction information with Timeline

Inside the app you possibly can immediately see what you’ve spent on your whole playing cards which can be related to Curve utilizing Timeline. You may as well seek for a transaction by typing within the search field or filter your transactions by quantity, date vary, class or forex.

In the event you faucet on a person transaction you possibly can assign it to a class, add a photograph receipt, write a word or mark it as a enterprise buy. In the event you want an e mail receipt for the transaction, you possibly can have it despatched to the e-mail linked to your Curve account. That is nice in the event you’re self employed or run a enterprise and want e mail receipts to account for bills and assist together with your bookkeeping.

Useful Insights

Faucet on the “insights” tab and also you’ll see a categorised breakdown of your spend throughout all of your playing cards on Curve. You may see your prime private spend by class, in addition to your prime enterprise spend by class. You may as well see which playing cards you’ve used probably the most.

Curve Money

It is a digital card within the Curve app. Your steadiness is made up of cash earned by means of cashback, promos, or referrals, and any cash despatched to you from different folks on Curve. If Curve isn’t in a position to course of a refund to your checking account, it’ll arrive in Curve Money.

Ship cash to buddies

You may ship cash to anybody else on Curve by utilizing their telephone quantity. Head to ‘Ship’ to see an inventory of your folks on Curve and you’ll ship them cash from any of your playing cards in your Curve Pockets. The cash despatched will immediately arrive of their Curve Money card.

Different options

Curve Fronted – Within the UK you possibly can’t pay your taxes on a private bank card, which is tremendous annoying. It’s important to use a debit card, so in the event you don’t have the cash to pay your tax invoice, this is usually a drawback. With Curve Fronted you possibly can pay your UK taxes or bank card payments with one other bank card. There’s a 1.5% payment per transaction for Curve Blue and Curve Black prospects, however the payment is waived in the event you get Curve Steel. You probably have a rewards bank card this implies you’ll additionally be capable of get rewards on the transaction.

Anti-Embarassment Mode – In the event you flip this characteristic on you’ll save your self from awkward moments in case your card will get declined on the checkout. In case your chosen cost card doesn’t undergo, Curve will robotically use your chosen backup card to pay.

Add Loyalty Playing cards – At all times forgetting your loyalty card on the checkout? Curve enables you to add your loyalty playing cards to the app by scanning the barcode in your bodily card. In case your loyalty program isn’t on the checklist you possibly can nonetheless manually add any barcode.

Earn 1% cashback within the first 30 days – Within the first 30 days after enroll you’ll earn 1% cashback on all of your purchases, even when you have the free model of the cardboard. After that when you have Curve Black you’ll get 1% cashback at 3 retailers you choose, whereas the Curve Steel provides you 1% cashback at 6 chosen retailers. Examples of shops you possibly can select from embody Aldi, Waitrose, Tesco, Burger King, Costa Espresso, Starbucks, Pret a Manger, Amazon, Apple, Boots, Topshop, Zara, H&M (and lots of extra).

Issues I like about Curve Card

Curve is full of options, whichever model you select. In my yr with Curve Steel I didn’t should make any journey insurance coverage claims or cell phone insurance coverage claims, so I can’t touch upon the convenience of the claims course of. Nonetheless, I can provide my opinion on the overall options of the Curve playing cards:

Nice when you have a number of playing cards – I’m a type of those that has plenty of totally different playing cards for various functions. Cashback playing cards, air miles bank cards, PayPal card, debit…you title it. It’s a ache to hold a bunch of various playing cards in all places so this permits me to make use of all of them whereas solely carrying one card. Whereas it really works a bit like Apple Pay, it’s higher since you get a bodily Mastercard, so you should use it at locations that don’t take Apple Pay. And in case your telephone dies, you possibly can nonetheless use the cardboard.

Helpful in the event you’re a frequent traveller or an expat – I’ve playing cards issued each within the UK and the US and Curve lets me add each to the Curve Pockets, regardless of which nation they have been issued in. Because the card provides truthful FX charges, I may journey realizing I’m not going to get hit with hefty charges. I used the cardboard no drawback and didn’t expertise any declines, though I did should approve a few funds within the app.

See funds in real-time – You probably have notifications turned on then you definately’ll get a push notification when the transaction is profitable. You may as well see transactions in real-time, as an alternative of ready for them to indicate up in your financial institution assertion.

Nice for freelancers and enterprise house owners – The cardboard is especially engaging for freelancers and enterprise house owners as a result of it means that you can do issues like mark issues as enterprise bills, add picture receipts and even have an e mail receipt despatched to you. No extra worrying about how one can separate your small business and private bills – you possibly can merely spend on whichever card after which mark it as a enterprise expense within the app.

Card might be locked in the event you lose it – In case your Curve card will get misplaced or stolen, you possibly can immediately lock it within the app.

My favourite characteristic: Again in Time

If there’s one motive you must positively get the Curve card, it’s positively their Again in Time characteristic. In the event you’ve paid on the fallacious card, you possibly can change funds from one card to a different, as much as 90 days after the cost was made. All you must do is faucet the transaction you need to transfer, click on “Go Again in Time” and swipe to the cardboard you’d wish to pay with as an alternative. It is a sensible characteristic that I used a number of instances, significantly if I needed to liberate house on considered one of my different bank cards. Curve runs the transaction in your new card and if it’s profitable, they immediately credit score your different card. Typically it could actually take a number of days for the refund to indicate up in your assertion, however I had nice success with this characteristic.

Issues I dislike about Curve Card

Refunds typically go to Curve money – Whereas on the entire most refunds went again to the unique card I paid on, typically they didn’t they usually ended up in my Curve Money pockets. The problem with Curve Money is you could’t withdraw the cash to your checking account, nor can you employ it to repay the cardboard you paid on. The one approach you should use it’s by utilizing the Curve Card to pay for issues and ensuring it robotically makes use of Curve Money first. I did discover one trick although to get round this – by opening a Revolut account, topping up my steadiness utilizing Curve Card after which withdrawing the cash from Revolut. So whereas this takes a little bit further effort, I did truly discover a answer to the issue.

Can’t use Amex – After I first signed up for Curve in 2016 I used to be in a position to hyperlink my American Specific card to Curve however sadly this characteristic now not exists. On the time it was an effective way to make use of my Amex in locations that didn’t truly settle for Amex. Sadly since as of late I do most of my spending on my Platinum Amex to get air miles, I do have to hold multiple card.

1% cashback is simply at chosen retailers – You don’t get 1% cashback on all purchases, simply on purchases at chosen retailers. You’d have to buy at these retailers fairly recurrently to see any profit, so it may be value selecting someplace the place you do your weekly grocery procuring, akin to Tesco or Waitrose.

In the event you get the free model, the truthful overseas alternate charges are capped – I’ve bank cards and debit playing cards that cost no charges overseas and there’s no restrict on the financial institution to financial institution alternate price. With Curve Blue, there’s a £500 cap on the truthful overseas alternate price. In the event you plan on utilizing the cardboard recurrently abroad or for overseas transactions, you’d positively want one of many paid, premium variations of Curve.

Price-free overseas ATM withdrawals have limits – In the event you journey so much and withdraw massive quantities at ATMs, you possibly can go previous your fee-free restrict, even with Curve Steel. Curve Steel’s max is £600 per 30 days.

Is Curve Steel value it?

I’d say Curve Steel is value it in the event you journey a good bit and don’t have issues like journey insurance coverage and cell phone insurance coverage already packaged together with your checking account. In the event you’re a frequent traveller then you definately’ll benefit from the lounge entry that comes with LoungeKey, together with the limitless truthful overseas alternate charges. I’d assess how a lot you suppose you’ll journey inside the yr to determine if it’s truly well worth the paid subscription. In the event you’re not planning to journey a lot then you definately’d be finest off with the free card, Curve Blue.

Curve Steel is a nice-looking card although with a premium really feel, so in the event you’re into aesthetics, you’ll like this card.

Need to get Curve?

Join utilizing my promo code TRAVL to get £5 whenever you enroll. Simply click on on this hyperlink https://www.curve.com/be part of#TRAVL