Certainly one of Donald Trump’s closing marketing campaign arguments was that he would ship a brand new “golden age” for America. This week, he introduced that this Trump-powered golden age has already begun.

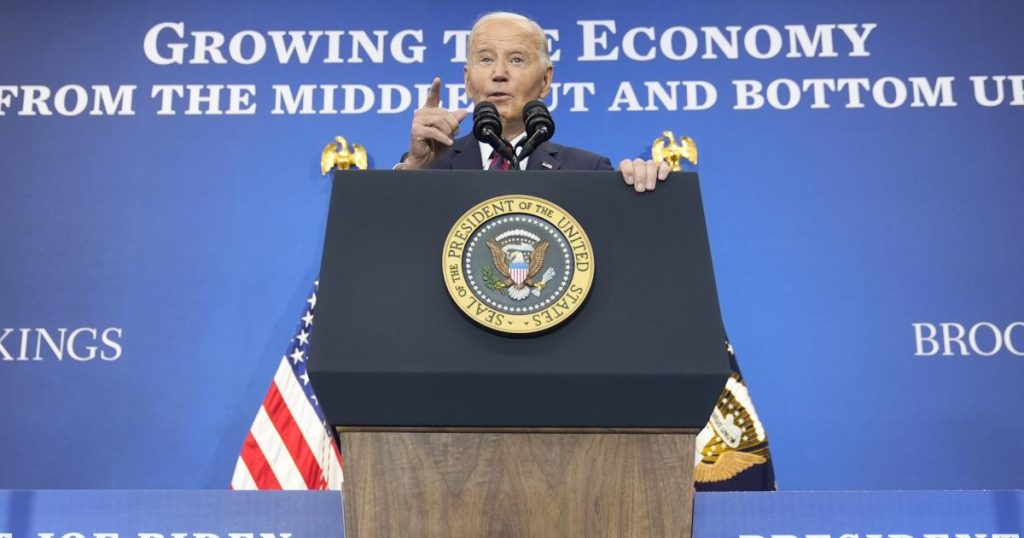

That’s becoming insofar as Trump has quickly eclipsed the present president, Joe Biden, in setting expectations and even an agenda for America at residence and overseas. It feels as if the clock on the second Trump administration has already began.

So has the same old battle over who ought to get the credit score — or blame — for the financial system the following president inherits. This occurs to some extent with each new president, no matter occasion and never simply with regards to the financial system.

Ronald Reagan’s vice chairman, George H.W. Bush, inherited his financial system, however Bush’s aides have been fast to notice that he additionally inherited an inevitable recession and a financial savings and mortgage disaster from the Gipper. Within the closing days of this 12 months’s election, Barack Obama complained that Trump had inherited his financial successes in 2017.

Trump has purpose to leap the gun on taking credit score for the financial system now: It’s doing amazingly effectively.

That’s to not decrease the ache of many People or ignore financial issues comparable to skyrocketing debt, inflation and dislocations in some areas and industries. Even amid a macroeconomic increase, folks dwell in microeconomic circumstances.

The U.S. financial system is however the envy of the world. Don’t take my phrase for it: The quilt of a particular problem of the Economist in October described the American financial system as simply that, the “Envy of the World,” noting that america “has left different wealthy international locations within the mud.” The Monetary Instances reached the similar conclusion this month.

It’s a stark distinction to the Nineteen Nineties, when many anticipated Europe’s economies to go away ours within the mud. In 2008, the European Union’s financial system was 10% greater than that of america. By 2022, it was 23% smaller. The EU grew 21% throughout this era, however the American financial system grew 72%.

Immediately the U.S. financial system generates a couple of quarter of worldwide output. U.S. shares account for 65% of worldwide equities, whereas Japan, China and the UK mixed account for simply over 10%. If Britain have been an American state, it would barely edge out Mississippi — our poorest state — in per capita gross home product.

There are numerous causes for this. People merely work more durable than residents of different wealthy international locations. Our productiveness has outstripped the eurozone’s greater than 3 to 1 since 2008. Our enterprise tradition is completely different too: We’re probably the most entrepreneurial nation within the world, and we regard enterprise failure not as a trigger for disgrace however as helpful expertise for the following try. America can be higher at assimilating immigrants than most international locations, and the immigrants we have a tendency to draw usually work very exhausting.

I may go on. The purpose is that now we have had completely different presidents with very completely different insurance policies and much more completely different rhetoric during the last 30 years. However U.S. financial tendencies — with the same old dips and spikes — have been largely constructive by means of all of these presidencies.

Because the Manhattan Institute’s Brian Riedl put it in Nationwide Affairs, “The notion that there’s a easy partisan sample to the well being of the financial system is an extension of the exaggerated politicization of our understanding of latest American life.”

Current dissatisfaction with the financial system, spurred by inflation, fueled the concept that America was doing particularly terrible underneath Biden. Once more, we dwell in microeconomies, so it’s comprehensible that many individuals had that view. However we’ve nonetheless been doing higher than just about everybody else.

Trump’s give attention to the financial draw back was typical for a presidential challenger and truthful sufficient. However he was flawed to recommend that our opponents have been consuming our lunch.

None of that is to recommend that presidents and their financial insurance policies don’t matter. It’s simply that they don’t matter as a lot as presidents and their partisans declare they do.