One piece of study generally misconstrued is the Federal Reserve’s position within the nation’s financial well being. Even those that have the power to piece collectively different variables that usually go unnoticed generally level their finger on the Federal Reserve. Nobody is factoring within the largest driver of inflation – WAR – nor are they factoring within the three foremost pillars of presidency debauchery (battle, taxation, authorities spending) that the Fed can’t management.

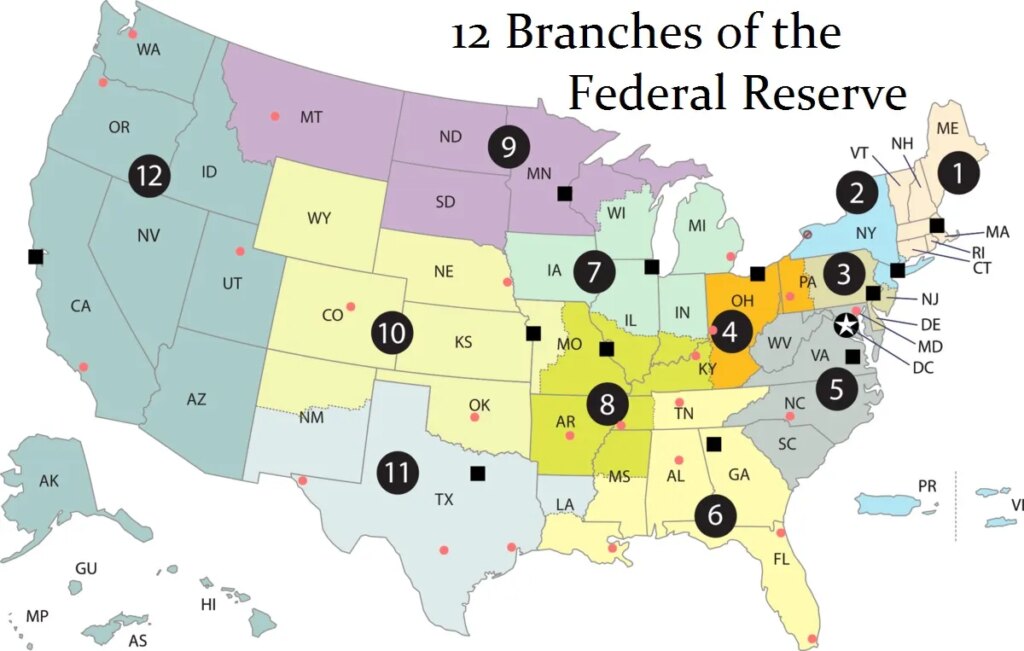

They by no means take a look at the historical past of central banks and the way Congress has been manipulating the regulation to change the Fed’s function. If there was a single rate of interest and one coverage set in Washington, why will we even have branches of the Fed in the event that they now not act independently? When the Fed was created, the branches managed inside home capital flows. Every department was unbiased, and they’d decrease or increase the rate of interest of their jurisdiction relying on the movement of cash. An excessive amount of money? They lowered the speed. Not sufficient money? They raised it. This was all earlier than Keynesian Economics when the rate of interest turned the device to govern our demand.

The San Francisco earthquake of 1906 created the Panic of 1907, which triggered capital to hurry from East to West. This created a scarcity of money in New York and led to financial institution failures. Therefore, the Federal Reserve was created with branches to govern the interior capital flows – not the Amount of Cash Idea or the demand of the individuals.

Roosevelt usurped all of the independence of the Fed and created a Washington monopoly to push his socialist agenda into place. We’re listening to the identical pitch of equality as soon as once more from Biden. The federal government is meant to be separate from the Federal Reserve, however the president appoints the chair. The previously unbiased central financial institution that was owned by the bankers to forestall the misuse of taxpayer funds is now underneath management by the banks solely in concept; the reins of energy are political.

The Federal Reserve failed to supply inflation whereas participating in QE between 2008 and 2019. Most analysts ignore that totally. If the Fed issued $1 trillion and buys in US Treasuries, I hate to inform you, however it could have ZERO impression. Why? As a result of debt immediately is just money that pays curiosity. As soon as upon a time, you could possibly not borrow in opposition to authorities debt. Thus, it was deemed non-inflationary so long as it couldn’t be used as cash. As we speak, you put up payments as collateral to commerce futures. The previous theories now not exist on this new, unusual world we reside in. Therefore, all of the QE was merely swapping the debt for money.

Additionally, think about the place the Fed purchases its debt and who purchases US debt. China, for instance, is now not shopping for US debt on account of US-China authorities relations that the Fed has completely no management over. Then, say China offered its debt for money. The greenback would go offshore, and the home cash provide would NOT improve. There’s much more to this recreation than the simplistic evaluation that results in brainwashing the monetary group and buyers.

Jerome Powell has no energy over fiscal spending or the deficit. Central banks all over the place are trapped. The central banks in Europe are in FAR worse form proper now. When Powell stood earlier than Congress and subtly criticized the Biden Administration by calling their fixed spending “unsustainable,” he was trying to clarify that the central financial institution couldn’t overpower the federal government right here. The central financial institution can create elastic cash, and it’ll return to doing so. Non-public capital is fleeing authorities debt on a world degree.

In the long run, the globalist agenda is to default on all nationwide money owed, and they’ll now not have to bail out the bankers. Welcome to the Decline & Fall of Western Civilization.