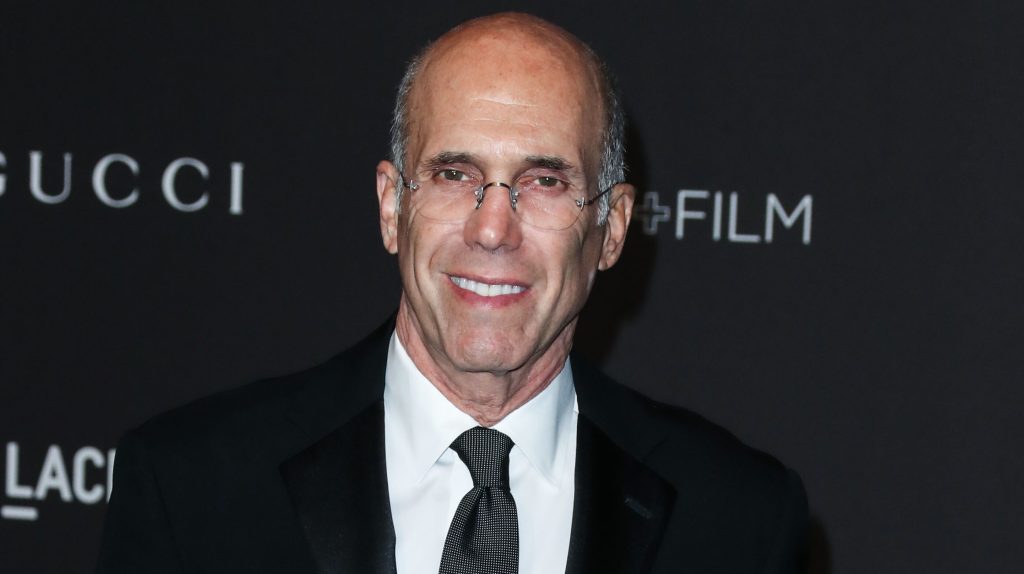

One other large Hollywood identify is rooting for a Paramount-Skydance deal as Jeffrey Katzenberg says that consequence could be “a fantastic win for Paramount and for folks within the business.”

Talking a the Axios BFD Talks: LA this night, the DreamWorks co-founder and former Walt Disney Studios head acknowledged that the scenario is sophisticated. “There’s a cause why the David Ellison deal didn’t fly, which I believe is unlucky. As a result of I believe David is an outstanding entrepreneur, and he’s tremendous bold, and loves the film enterprise, the studio enterprise. I believe that may have been a fantastic win for Paramount and for folks within the business.”

“The financial complexity of how this has type of performed out, over many years, by the way in which, makes it actually exhausting to get to a profitable consequence. However not not possible. And I might say don’t rely Ellison out,” stated Katzenberg whose final enterprise was the fleeting 2020 cellular app Quibi for brief kind video, financed by his enterprise capital agency WndrCo..

Paramount, in actual fact, continues to be speaking with Ellison regardless that an unique negotiating window ended, and regardless that additionally it is partaking with a rival bidding group of Sony and Apollo. The latter deal has extra money for shareholders however faces regulatory dangers.

“Clearly, that [Sony-Apollo offer] can create an exit for shareholders and buyers who’ve been with this firm for a really very long time, and it’s been an actual curler coaster journey. [But] I wouldn’t say that’s it has straight path ahead.”

Sony can’t personal broadcast belongings and the thought is that Apollo would take them on. However “to imagine that the FCC goes to permit a personal fairness agency to take that license? I imply, simply take into consideration that. That is the license to function the number-one broadcast community in America, and the FCC has an absolute proper to approve this. They’re going to say that there’s a profit for that being within the fingers of personal fairness? I don’t know. That’s a excessive bar, notably within the regulatory atmosphere that we’re in proper now,” Katzenberg stated

There’s a 3rd choice, Paramount’s controlling shareholders Shari Redstone simply decides to take a seat tight, not do both deal, and take a run at it in one other yr or two.”

Ellison and backers Larry Ellison and RedBird Capital would purchase out Redstone’s stake with a little bit of sweetener to widespread shareholders however not almost sufficient to make them blissful. The corporate would keep collectively and keep public. Hollywood likes this deal.

Sony and Apollo are providing $26 billion, together with the idea of Paramount’s debt, to accumulate the entire firm and take it non-public. A particular committee of Par’s board determined yesterday to interact with each. Shareholders like this one,