Synthetic intelligence (AI) chip large Nvidia says its revenues for the three months to the tip of July greater than doubled in comparison with a yr earlier, hitting a document $30bn (£24.7bn).

Nonetheless, the agency’s shares fell by greater than 6% in New York after the announcement.

Nvidia has been one of many greatest beneficiaries of the AI increase, with its inventory market worth hovering to greater than $3tn.

The corporate’s shares have risen by greater than 160% this yr alone.

“It’s much less about simply beating estimates now, markets count on them to be shattered and it’s the size of the beat at present that appears to have dissatisfied a contact,” stated Matt Britzman, senior fairness analyst at Hargreaves Lansdown.

The sky-high expectations are pushed by its valuation, which has surged ninefold in worth in beneath two years because of its dominance of the AI chip market.

Earnings for the interval soared, with working earnings rising 174% from the identical time final yr to $18.6bn.

It was the seventh quarter in a row that Nvidia had crushed analysts’ expectations on each gross sales and income.

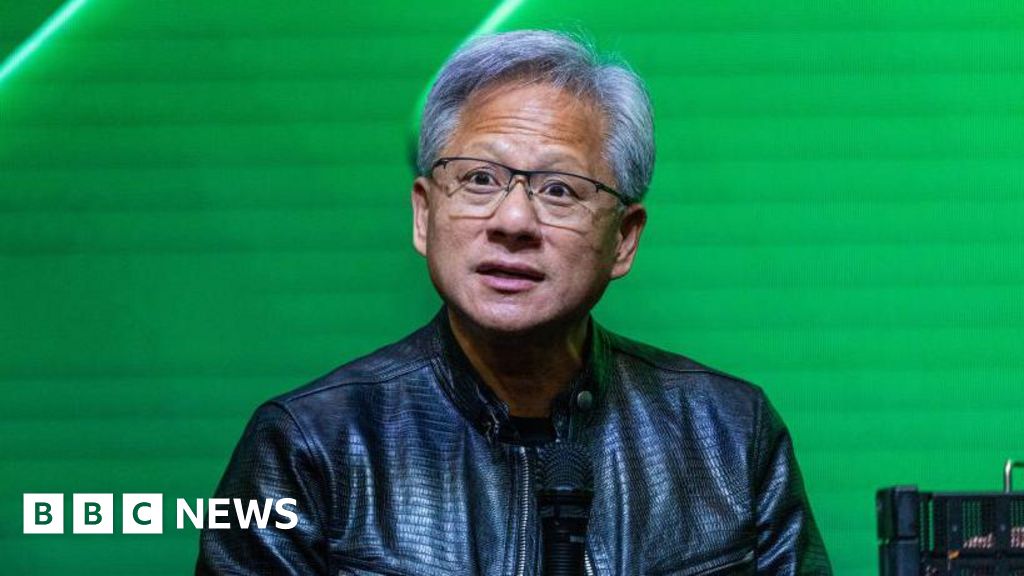

“Generative AI will revolutionise each business,” stated Nvidia chief govt Jensen Huang.

The outcomes have turn out to be a quarterly occasion which sends Wall Road right into a frenzy of shopping for and promoting shares.

A “watch celebration” had been deliberate in Manhattan, in response to the Wall Road Journal, whereas Mr Huang, famed for his signature leather-based jacket, has been dubbed the “Taylor Swift of tech”.

Alvin Nguyen, senior analyst at Forrester, informed the BBC each Nvidia and Mr Huang have turn out to be the “face of AI”.

This has helped the corporate up to now, but it surely might additionally harm its valuation if AI fails to ship after companies have invested billions of {dollars} within the expertise, Mr Nguyen stated.

“A thousand use circumstances for AI is just not sufficient. You want 1,000,000.”

Mr Nguyen additionally stated Nvidia’s first-mover benefit means it has market-leading merchandise, which its prospects have spent many years utilizing and has a “software program ecosystem”.

He stated that rivals, comparable to Intel, might “chip away” at Nvidia’s market share in the event that they developed a greater product, although he stated this might take time.