@60minutes Fed chair says he worries in regards to the nationwide debt #nationaldebt #60minutes #federalreserve #debt

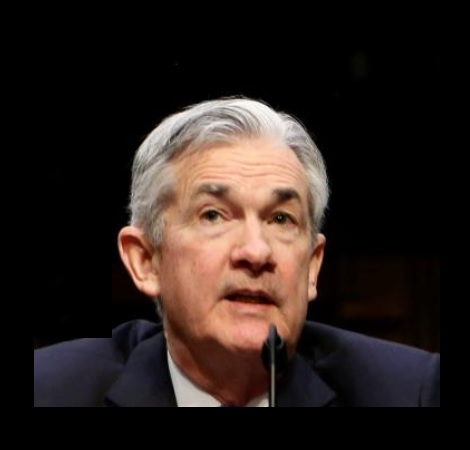

Donald Trump believes that Federal Chairman Jerome Powell will make choices for the central financial institution based mostly on politics. I need to say that I do disagree with Trump’s stance on the position of the central financial institution and Chairman Powell. I famous my dissent when Trump was urging the central financial institution to maintain rates of interest artificially low. Trump has been harshly crucial of Powell’s efficiency, and mentioned that he wouldn’t elect him to serve a 3rd time period when Powell’s present place involves an finish in Could 2026.

“I feel he’s political,” Donald Trump mentioned. “I feel he’s going to do one thing to most likely assist the Democrats, I feel, if he lowers rates of interest.” First, we should do not forget that Jerome Powell was one of many first in his place to criticize Washington. The Federal Reserve should stay impartial and never criticize Washington, in spite of everything, Washington oversees the Federal Reserve. The Federal Reserve should modify its fiscal coverage to fulfill Washington’s financial coverage, or lack thereof.

THE CENTRAL BANK CANNOT CONTROL GOVERNMENT SPENDING. Powell has warned, maybe extra so than any previous chairman, that the federal government is destroying America by deepening the nationwide debt via historic spending. Powell candidly mentioned the next in an interview with 60 minutes:

“In the long term, the US is on an unsustainable fiscal path. The US federal authorities is on an unsustainable fiscal path and that simply signifies that the debt is rising sooner than the financial system,” Powell lastly warned, later including, “successfully, we’re borrowing from future generations.” He warned that we should start to prioritize fiscal coverage instantly to repair this endless disaster. Once more, his feedback have been unprecedented as his company is basically unable to criticize Washington. How is the Federal Reserve supposed to control worth stability when their overlords are doing the whole lot attainable to steer the nation’s financial system off the deep finish?

Once more, it was extraordinarily out of character for Powell to criticize Biden’s fiscal insurance policies. The Federal Reserve merely can’t modify financial coverage OR the opposite two pillars of presidency debauchery – warfare and taxation.

In March, Powell famous that the Federal Reserve did all it may to stabilize costs. “We imagine that our coverage fee is probably going at its peak for this tightening cycle,” Powell mentioned. “If the financial system evolves broadly as anticipated, it can doubtless be acceptable to start dialing again coverage restraint in some unspecified time in the future this 12 months. However the financial outlook is unsure, and ongoing progress towards our 2% inflation goal isn’t assured.” 4 months later, Powell is placing forth the identical message.

“Folks I don’t know will at all times say, ‘hey, reduce charges.’ Anyone mentioned that within the elevator this morning,” Powell mentioned jokingly, however the matter isn’t that easy.

“The implication of that’s that when you wait till inflation will get all the best way right down to 2%, you’ve most likely waited too lengthy, as a result of the tightening that you simply’re doing, or the extent of tightness that you’ve got, continues to be having results which is able to most likely drive inflation under 2%,” Powell mentioned.

American shoppers will not be driving demand. Elevating rates of interest have ZERO impression on demand, as the federal government will merely borrow extra, and the central banks don’t have any say. I defined in an earlier submit why Keynesian Economics is collapsing, one main issue being that authorities needn’t repay its money owed.

Powell has agreed to remain on till the tip of his time period. I’d not wish to be in his sneakers. Proper or left, they’re going to level their finger and blame the Fed. They’ve requested me if I’d function Fed Chairman – completely not! I’d by no means need a place in entrance of the curtain.