Nvidia, which makes microchips that energy most synthetic intelligence functions, started an extraordinary run a 12 months in the past.

Fueled by an explosion of curiosity in A.I., the Silicon Valley firm mentioned final Might that it anticipated its chip gross sales to undergo the roof. They did — and the fervor didn’t cease, with Nvidia elevating its income projections each few months. Its inventory soared, driving the corporate to a greater than $2 trillion market capitalization that makes it extra helpful than Alphabet, the guardian of Google.

On Wednesday, Nvidia once more reported hovering income and earnings that underscored the way it stays a dominant winner of the A.I. increase, even because it grapples with outsize expectations and rising competitors.

Income was $26 billion for the three months that led to April, surpassing its $24 billion estimate in February and tripling gross sales from a 12 months earlier for the third consecutive quarter. Internet revenue surged sevenfold to $5.98 billion.

Nvidia additionally projected income of $28 billion for the present quarter, which ends in July, greater than double the quantity from a 12 months in the past and better than Wall Avenue estimates.

“We’re poised for our subsequent wave of development,” Jensen Huang, Nvidia’s chief government, mentioned in a press release.

A doubling fairly than tripling of income would mirror the best way skyrocketing gross sales of A.I. chips started remodeling Nvidia’s outcomes a 12 months in the past. These development charges are anticipated to sluggish now that the preliminary ramp-up makes year-over-year comparisons more durable.

Nvidia’s shares, that are up greater than 90 % this 12 months, rose in after-hours buying and selling after the outcomes have been launched. The corporate additionally introduced a 10-for-1 inventory cut up.

Nvidia, which initially offered chips for rendering photographs in video video games, has benefited after making an early, expensive wager on adapting its graphics processing models, or GPUs, to tackle different computing duties. When A.I. researchers started utilizing these chips greater than a decade in the past to speed up duties like recognizing objects in photographs, Mr. Huang jumped on the chance. He augmented Nvidia’s chips for A.I. duties and developed software program to assist developments within the discipline.

The corporate’s flagship processor, the H100, has loved feverish demand to energy A.I. chatbots comparable to OpenAI’s ChatGPT. Whereas most high-end commonplace processors price a couple of thousand {dollars}, H100s have offered for anyplace from $15,000 to $40,000 every, relying on quantity and different components, analysts mentioned.

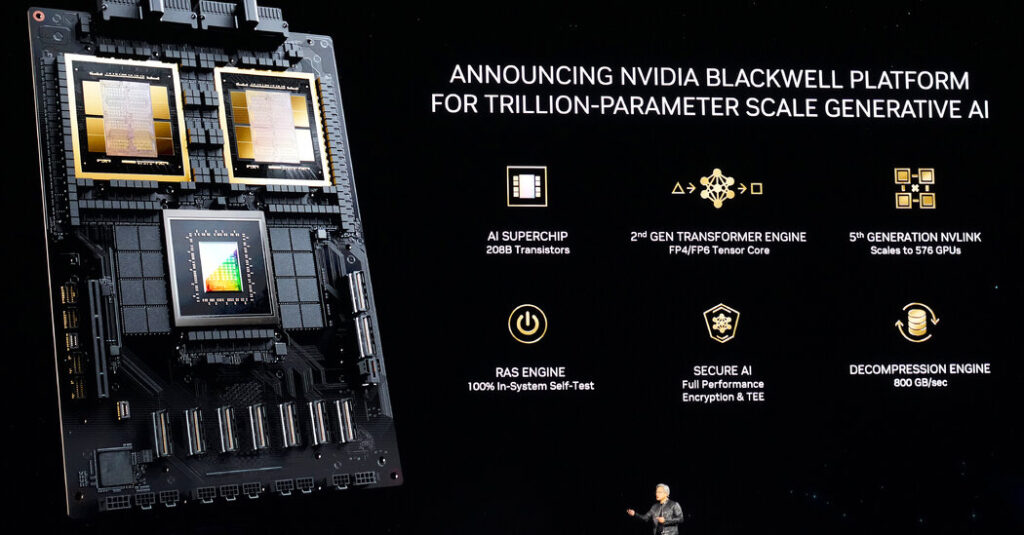

Analysts are debating the potential results of a strong successor to the H100, code-named Blackwell, which was introduced in March and is predicted to start showing in preliminary fashions within the fall.

Demand for the brand new chips already seems to be robust, elevating the likelihood that some prospects might look ahead to the quicker fashions fairly than purchase the H100. However there was little signal of such a pause in Nvidia’s newest outcomes.

Wall Avenue analysts are additionally in search of indicators that some richly funded rivals may seize a noticeable share of Nvidia’s enterprise. Microsoft, Meta, Google and Amazon have all developed their very own chips that may be tailor-made for A.I. jobs, although they’ve additionally mentioned they’re boosting purchases of Nvidia chips.

Conventional rivals comparable to Superior Micro Units and Intel have additionally made optimistic predictions about their A.I. chips. AMD has mentioned it expects to promote $4 billion price of a brand new A.I. processor, the MI300, this 12 months.

Mr. Huang steadily factors to what he has mentioned is a sustainable benefit: Solely Nvidia’s GPUs are supplied by all the key cloud providers, comparable to Amazon Net Providers and Microsoft Azure, so prospects don’t have to fret about getting locked into utilizing one of many providers due to its unique chip know-how.

Nvidia additionally stays fashionable amongst laptop makers which have lengthy used its chips of their programs. One is Dell Applied sciences, which on Monday hosted a Las Vegas occasion that featured an look by Mr. Huang.

Michael Dell, Dell’s chief government and founder, mentioned his firm would supply new knowledge middle programs that packed 72 of the brand new Blackwell chips in a pc rack, commonplace buildings that stand a bit taller than a fridge.

“Don’t seduce me with speak like that,” Mr. Huang joked. “That will get me superexcited.”