What sort of oil-drunk capitalist pushes their chips onto ultra-prime actual property, tech moonshots and status sporting occasions whereas protecting each floor in gold leaf?

The usual comparisons and analogies don’t fairly seize President Trump’s specific financial imaginative and prescient. It isn’t actually an extension of the Gilded Age robber barons, nor — regardless of his critics’ claims — is it akin to the fascist financial fashions of Thirties Germany or Italy.

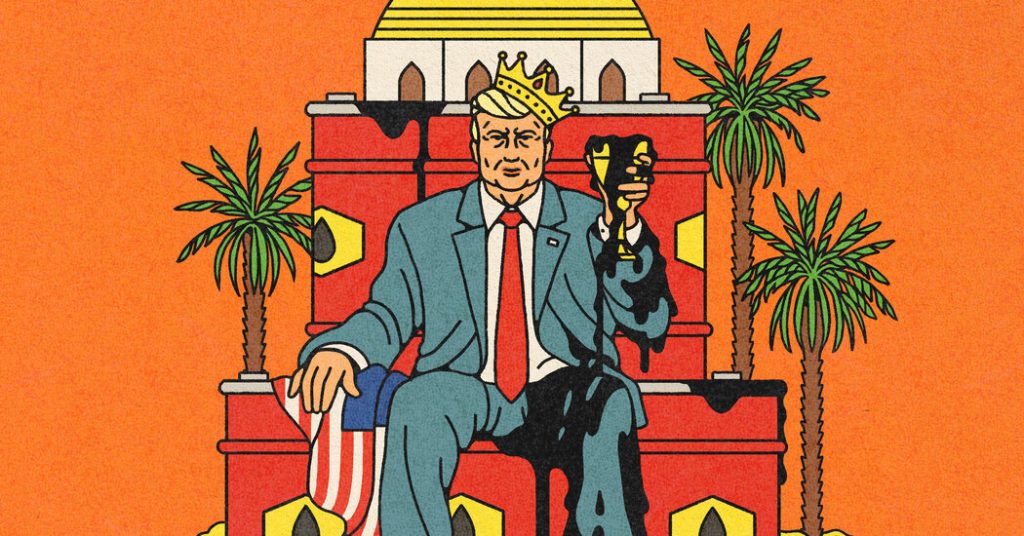

There may be one other mind-set about his model of political financial system, and a possible mannequin for it. We would consider the autocratic, oil-rich states of the Persian Gulf. Particularly, we’d consider Mr. Trump’s imaginative and prescient as an try and transplant the political financial system of Saudi Arabia onto the USA.

The connection between Mr. Trump, his household and the Kingdom of Saudi Arabia runs deep. His resort enterprise dealings within the area have grown since his earlier time period within the Oval Workplace, and his ties to Saudi Arabia now lengthen to golf, a sport the dominion has aggressively expanded into. Certainly one of its tournaments has been hosted by Mr. Trump’s signature course in Miami, and the president made time just lately to help in talks to dealer a deal between LIV Golf, which is owned by Saudi Arabia’s Public Funding Fund, and the PGA Tour.

Quickly after the election, Mr. Trump attended an Final Combating Championship match in Madison Sq. Backyard with Elon Musk, Joe Rogan and a lesser-known determine: Yasir al-Rumayyan, the top of the Saudi sovereign fund. The dominion’s sovereign fund bankrolls each steady belongings and high-risk prospects. This week, the U.F.C. chief govt, Dana White, a Trump ally, introduced the beginning of a brand new boxing league in Saudi Arabia to make the game “nice once more.”

Certain, one option to interpret this alliance is as purely transactional — a enterprise govt cozying as much as a wealthy nation. However a more in-depth look means that this isn’t merely a couple of sequence of actual property and leisure offers.

Saudi Arabia’s financial energy rests on its huge oil reserves, and Mr. Trump has embraced a parallel strategy — championing “drill, child, drill,” rolling again environmental restrictions and prioritizing vitality growth.

Final month, Mr. Trump shared on his social media platform an A.I.-generated video of the demolished Gaza Strip reborn as a “Trump Gaza” of casinos, poolside drinks and a large idol of the developer-president-sovereign himself. That’s the embodiment of the shared Gulf state dream: autocratic technocapitalism in glitz and glass.

For a minimum of a decade, Saudi Arabia has sought to maneuver past oil. Crown Prince Mohammed bin Salman’s Imaginative and prescient 2030 plan goals to diversify the dominion’s financial system, imitating the financial fashions of Dubai and Abu Dhabi. In recent times, the Saudis have expanded into leisure, luxurious structure and cutting-edge infrastructure, investing in desalination, inexperienced hydrogen and main tech ventures. Amongst these was a $3.5 billion funding in Uber and almost $2 billion to assist Elon Musk buy Twitter. Most large-scale investments are funneled by means of the sovereign fund.

Mr. Trump’s personal plans more and more mirror this mannequin. Some concern he may dump federally owned lands to create a sovereign wealth fund. At a latest occasion in Miami for Saudi buyers, he spoke in regards to the interplay of synthetic intelligence and vitality consumption. “The world runs on low-cost vitality, and energy-producing nations like us don’t have anything to apologize for,” he mentioned.

In late January, Mr. Trump hosted Sam Altman and Larry Ellison within the White Home for the announcement of the $500 billion Stargate infrastructure funding challenge. Becoming a member of them was Masayoshi Son of SoftBank, one other main beneficiary of Saudi funding lately.

Saudi Arabia and its Emirati neighbors are the worldwide financial institution the place everybody finally comes knocking, hat in hand.

The dominion’s political mannequin can be related. Mr. Trump raised eyebrows when he posted a picture of himself carrying a crown, captioned “Lengthy dwell the king.” Saudi Arabia’s centralized management mirrors the male-dominated household dynasty Mr. Trump has been cultivating inside his personal political empire.

His son Eric Trump oversees actual property and resorts, and his son-in-law Jared Kushner operates in adjoining monetary spheres. One other son, Donald Trump Jr., serves as a roving scout for brand spanking new political expertise — what he calls a “MAGA bench for the longer term,” which introduced him into contact with JD Vance — and new investments, most just lately exploring ventures in Greenland.

The dominion’s patriarchal governance additionally aligns with the social imaginative and prescient of Mr. Trump’s allies. The Saudi authorities enforces strict gender norms and a prohibition on pornography that appears to reflect the rhetoric and calls for of the Challenge 2025 platform written partly by main members of Mr. Trump’s administration. And Mr. Vance has advocated a rollback of rights for same-sex {couples} and transgender People. Saudi Arabia’s legal guidelines, way more excessive than Mr. Vance’s proposals, embody strict bans on gender nonconformity and the potential use of the dying penalty for gay relations.

The Trump administration’s rising hostility towards unbiased journalism — more and more choosing allies for press entry and triggering investigations into critics of the president — echoes Saudi Arabia’s personal disregard for press freedom. The World Press Freedom index ranks the dominion 166 out of 180 international locations.

Nonetheless, Saudi Arabia is embraced by elites worldwide — not due to shared values, however as a result of in a time of excessive rates of interest, petro-states are among the many few entities with surplus capital to take a position.

Mr. Trump’s mannequin of autocratic capitalism depends on the identical logic. Like Saudi Arabia, the USA is an indispensable nation — whether or not for protection, vitality or funding.

The Trumpist challenge will not be about “Making America Nice Once more” in any conventional sense; moderately, it’s about reshaping America a minimum of partly within the picture of a contemporary petrostate — one which leverages vitality wealth, luxurious improvement and monetary capital to exert affect on the worldwide stage.

The way forward for this mannequin of political financial system is in flux. Saudi Arabia has begun work on flamboyant megaprojects like a golden dice in Riyadh giant sufficient to carry the Empire State Constructing and a would-be metropolis within the desert comprising two steady 100-mile-long mirrored skyscrapers. However oil costs want to remain excessive for the dominion’s checks to clear — and the prices aren’t solely financial. ITV reported that knowledge counsel over 21,000 staff have died since Imaginative and prescient 2030 started in 2016. The shimmering sci-fi metropolis of the promotional movies and prospectuses has thus far yielded solely a single unfinished seaside resort thrice over finances, for a complete value of $4 billion. The techno kingdom’s future imaginative and prescient appears ever extra like what The Wall Avenue Journal referred to as a “dance of mutual delusion” with consultants and starchitects dazzling the monarch simply sufficient to maintain extending their contracts.

Mr. Trump’s “every part in all places suddenly” technique of deregulation and extraction, mixed with inflated guarantees and incoherent commerce coverage, suggests an analogous sense that point is of the essence — and will work towards him. Drill an excessive amount of and oil costs begin to fall. Act too erratically and world buyers begin to flee tech shares that prop up the entire market. Associate with a chief govt who throws “Roman salutes” and folks cease shopping for his automobiles. Deal with tariffs like tweets and provide chains begin to crack. Even the worth of the $TRUMP cryptocurrency meme coin has fallen properly over 80 % since its launch simply earlier than the inauguration.

This week’s risky inventory markets, with “recession warnings blaring,” may be one of many sharper reminders in regards to the autocratic technocapitalism mannequin: Not all that glitters is gold.