Silicon Valley prides itself on disruption: Begin-ups develop new applied sciences, upend present markets and overtake incumbents. This cycle of inventive destruction introduced us the private laptop, the web and the smartphone. However lately, a handful of incumbent tech firms have sustained their dominance. Why? We consider they’ve realized easy methods to co-opt probably disruptive start-ups earlier than they will turn out to be aggressive threats.

Simply have a look at what’s occurring to the main firms in generative synthetic intelligence.

DeepMind, one of many first outstanding A.I. start-ups, was acquired by Google. OpenAI, based as a nonprofit and counterweight to Google’s dominance, has raised $13 billion from Microsoft. Anthropic, a start-up based by OpenAI engineers who grew cautious of Microsoft’s affect, has raised $4 billion from Amazon and $2 billion from Google.

Final week, the information broke that the Federal Commerce Fee was investigating Microsoft’s dealings with Inflection AI, a start-up based by DeepMind engineers who used to work for Google. The federal government appears to be all in favour of whether or not Microsoft’s settlement to pay Inflection $650 million in a licensing deal — on the similar time it was gutting the start-up by hiring away most of its engineering crew — was an finish run round antitrust legal guidelines.

Microsoft has defended its partnership with Inflection. However is the federal government proper to be fearful about these offers? We expect so. Within the brief run, partnerships between A.I. start-ups and Massive Tech give the start-ups the large sums of money and hard-to-source chips they need. However in the long term, it’s competitors — not consolidation — that delivers technological progress.

As we speak’s tech giants had been as soon as small start-ups themselves. They constructed companies by determining easy methods to commercialize new applied sciences — Apple’s private laptop, Microsoft’s working system, Amazon’s on-line market, Google’s search engine and Fb’s social community. These new applied sciences didn’t a lot compete with incumbents as route round them, providing new methods of doing issues that upended the expectations of the market.

However that sample of start-ups innovating, rising and leapfrogging incumbents appears to have stopped. The tech giants are outdated. Every was based greater than 20 years in the past — Apple and Microsoft within the Nineteen Seventies, Amazon and Google within the Nineteen Nineties, and Fb in 2004. Why has no new competitor emerged to disrupt the market?

The reply isn’t that right this moment’s tech giants are simply higher at innovating. The perfect out there proof — patent knowledge — means that improvements usually tend to come from start-ups than established firms. And that’s additionally what financial principle would predict.

An incumbent with a big market share has much less incentive to innovate as a result of the brand new gross sales that an innovation would generate would possibly cannibalize gross sales of its present merchandise. Gifted engineers are much less passionate about inventory in a big firm that isn’t tied to the worth of the mission they’re engaged on than inventory in a start-up which may develop exponentially. And incumbent managers are rewarded for creating incremental enhancements that fulfill their present prospects quite than disruptive improvements which may devalue the talents and relationships that give them energy.

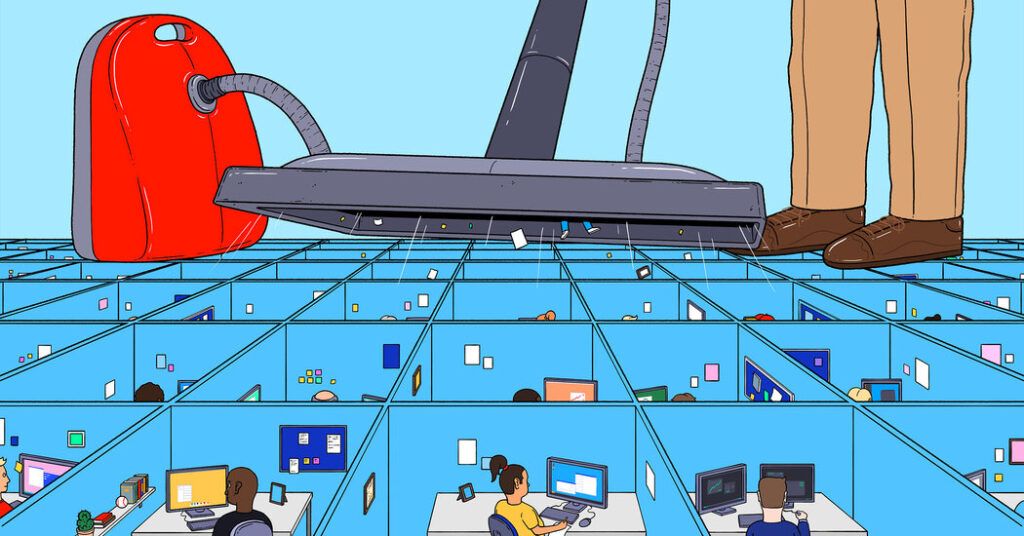

The tech giants have realized to cease the cycle of disruption. They put money into start-ups creating disruptive applied sciences, which provides them intelligence about aggressive threats and the flexibility to affect the start-ups’ course. Microsoft’s partnership with OpenAI illustrates the issue. In November, Satya Nadella, Microsoft’s chief govt, mentioned that even when OpenAI disappeared all of a sudden, his prospects would don’t have any trigger to fret, as a result of “we’ve got the folks, we’ve got the compute, we’ve got the info, we’ve got every thing.”

In fact, incumbents have all the time stood to achieve from choking off competitors. Earlier tech firms like Intel and Cisco understood the worth of buying start-ups with complementary merchandise. What’s totally different right this moment is that tech executives have realized that even start-ups outdoors their core markets can turn out to be harmful aggressive threats. And the sheer dimension of right this moment’s tech giants offers them the money to co-opt these threats. When Microsoft was on trial for antitrust violations within the late Nineteen Nineties, it was valued within the tens of billions. Now it’s over 3 trillion.

Along with their cash, the tech giants can leverage entry to their knowledge and networks, rewarding start-ups that cooperate and punishing people who compete. Certainly, that is one of many authorities’s arguments in its new antitrust lawsuit in opposition to Apple. (Apple denied these claims and has requested for the case to be dismissed.) They will additionally use their connections in politics to encourage regulation that serves as a aggressive moat.

Bear in mind these Fb adverts advocating higher web regulation? Fb wasn’t shopping for them for charity. Fb’s proposals “consist largely of implementing necessities for content material moderation programs that Fb has beforehand put in place,” concludes tech-investigations web site The Markup. That will give it a first-mover benefit over the competitors.

When these techniques fail to steer a start-up away from competing, the tech giants can merely purchase it. Mark Zuckerberg made this clear in an e-mail to a colleague earlier than Fb purchased Instagram. If start-ups like Instagram “develop to a big scale,” he wrote, “they may very well be very disruptive to us.”

The tech giants additionally domesticate repeat-player relationships with enterprise capitalists. Begin-ups are dangerous investments, so for a enterprise fund to succeed, a minimum of one in every of its portfolio firms should generate exponential returns. As preliminary public choices have declined, enterprise capitalists have more and more turned to acquisitions to ship these returns. And the enterprise capitalists know that solely a small variety of firms can purchase a start-up at that sort of value, so that they keep pleasant with Massive Tech in hopes of steering their start-ups to offers with incumbents. That’s why some outstanding enterprise capitalists oppose stronger antitrust enforcement: It’s dangerous for enterprise.

Co-option could appear innocent within the brief run. Some partnerships between incumbents and start-ups are productive. And acquisitions give enterprise capitalists the returns they should persuade their traders to commit extra capital to the subsequent wave of start-ups.

However co-option undermines technological progress. When one of many tech giants buys a start-up, it would shut down the start-up’s expertise. Or it would divert the start-up’s folks and property to its personal innovation wants. And even when it does neither, the structural obstacles that inhibit innovation at massive incumbents might sap the creativity of the acquired start-up’s workers. A.I. seems to be like a traditional disruptive expertise. However because the disruptive start-ups that pioneered it get tied up with Massive Tech one after the other, it might turn out to be nothing greater than a method of automating search engines like google and yahoo.

The Biden administration can step in to start to resolve this downside.

Earlier this 12 months, the F.T.C. introduced it was investigating Massive Tech’s offers with A.I. firms. That’s a promising begin. However we have to change the foundations that make co-option potential.

First, Congress ought to increase the legislation of “interlocking directorates” — which prohibits an organization’s administrators or officers from serving as administrators or officers for its rivals — to forestall the tech giants from placing their workers on start-up boards. Second, the courts ought to penalize dominant firms that discriminate in entry to their knowledge or networks on the premise of whether or not the corporate is a possible competitor. Third, as Congress strikes to control A.I., it ought to take care to write down guidelines that don’t entrench incumbents.

Lastly, the federal government ought to determine a listing of probably disruptive applied sciences — we’d begin with A.I. and digital actuality — and announce that it’s going to presumptively problem any mergers between the tech giants and start-ups creating these applied sciences. That coverage would possibly make life tough for enterprise capitalists who like to provide talks about disruption after which get drinks with their buddies in company improvement at Microsoft. However it will be excellent news for founders who need to promote merchandise to prospects, not start-ups to monopolies. And it will be good for shoppers, who depend upon competitors however have spent too lengthy with out it.

Mark Lemley is a professor at Stanford Regulation College and co-founder of the authorized analytics start-up Lex Machina. Matt Wansley is an affiliate professor at Cardozo College of Regulation and was normal counsel of the automated driving start-up nuTonomy.

The Occasions is dedicated to publishing a variety of letters to the editor. We’d like to listen to what you consider this or any of our articles. Listed here are some suggestions. And right here’s our e-mail: letters@nytimes.com.

Observe the New York Occasions Opinion part on Fb, Instagram, TikTok, WhatsApp, X and Threads.