I’m near-term barely extra optimistic however long-term pessimistic in regards to the means of america to cope with its price range issues. My uptick in optimism comes from a deal in Washington, whereas the pessimism comes from what I heard at an economics convention in San Antonio that I attended final weekend.

First, the excellent news: Going through the prospect of a partial authorities shutdown, Home and Senate leaders introduced on Sunday that that they had agreed on a plan for the remainder of this fiscal 12 months that might put discretionary spending across the stage that President Biden and then-speaker Kevin McCarthy agreed to final 12 months.

Congress nonetheless has to show that deal into passing 4 spending payments by a Jan. 19 deadline, and one other eight of them by a second deadline on Feb. 2. “This isn’t going to be straightforward, to offer the understatement of 2024,” stated Senator Susan Collins of Maine, the highest Republican on the Senate Appropriations Committee.

And there are quite a lot of issues with the deal, together with a minimize for the Inner Income Service — insisted upon by Republicans — that can make it simpler for wealthy taxpayers to get away with dishonest and cut back the sources out there to the federal government.

However as flawed and fragile because the weekend deal is, it at the very least offers some hope that compromise over price range issues is feasible.

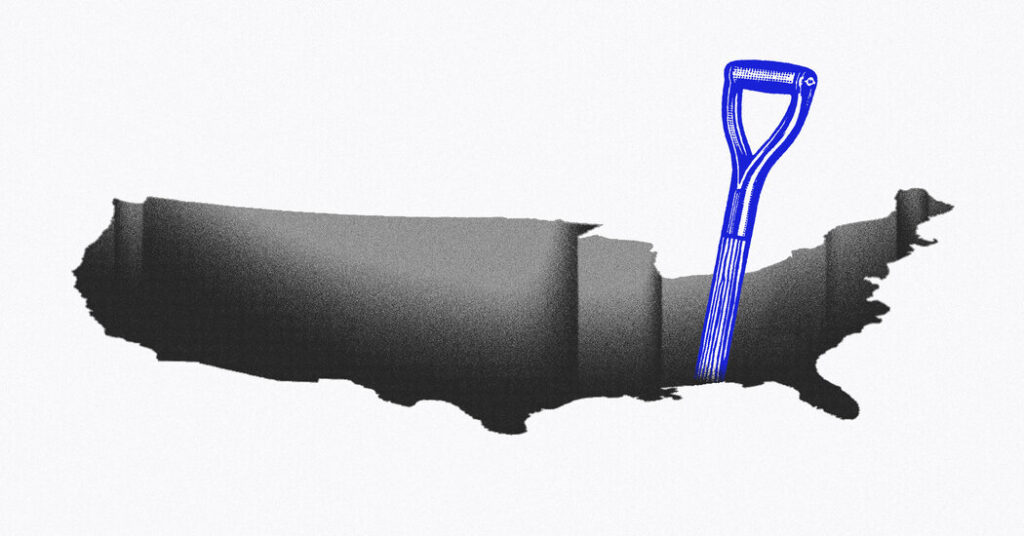

What’s scary is that nothing that’s happening in Washington even begins to cope with the primary drawback, which is a power imbalance between income and spending that’s inflicting the federal government debt to rise inexorably. If immediately’s fights over pretty small spending changes can carry the federal government to the brink of shutdown, what hope is there of attaining the far greater modifications in taxes and spending that can be required to shrink deficits meaningfully?

Out-of-control deficits had been the subject of an illuminating session on Friday at that convention I discussed, the American Financial Affiliation annual assembly in San Antonio. This explicit session featured Ellen Zentner, the chief U.S. economist of Morgan Stanley; Dana Peterson, the chief economist of the Convention Board, a business-supported analysis group; and Karen Dynan, a former chief economist of the Treasury Division who teaches at Harvard and is a senior fellow on the Peterson Institute for Worldwide Economics.

Right here’s the issue: As this chart reveals, the Congressional Price range Workplace initiatives immediately’s already enormous deficits to widen steadily by means of 2053 (and past) below its baseline assumptions. The bottom line assumes no change in present regulation. Subsequently, it assumes tax charges will rise when provisions of the 2017 Tax Cuts and Jobs Act expire in coming years. If the regulation modifications and the tax cuts are prolonged, deficits can be even greater than those within the chart.

The next chart reveals what’s behind the projected enhance in deficits: flat income coupled with rising spending.

Spending is rising as a share of gross home product for 2 important causes: First, society is growing old, so the price of Social Safety, Medicare and different packages for older Individuals is rising. Second, curiosity funds are rising as a result of, in fact, the debt is rising.

Curiosity funds had been manageable in the course of the lengthy interval when the Federal Reserve suppressed rates of interest to stimulate financial development, however they’ve shot up for the reason that Fed raised charges to quell inflation.

“I don’t assume the trail of the debt is sustainable below present coverage,” Dynan stated in San Antonio. She stated that present deficits aren’t only a “pig within the python” — that’s, a giant lump that can progressively be digested. Until one thing modifications, she stated, they are going to continue to grow. I invite you to think about a pig that retains rising inside a python. And we’re the python.

“I don’t assume lawmakers are doing us a service” by declaring some doable fixes off the desk, Dynan stated. President Biden has promised to not elevate taxes on folks incomes lower than $400,000 a 12 months, and Republicans are decided to increase tax cuts for folks incomes even above that. I’ve argued that greater taxes must be a part of the price range repair.

In the meantime, each events have shied away from discussing modifications to Social Safety and Medicare. Dynan acknowledged that reforms in these packages are delicate, however she stated it’s vital to be taught extra about how varied urged fixes would have an effect on totally different segments of the inhabitants. Such modifications don’t must be regressive. One concept is to make use of common tax income to complement payroll taxes. One other is to lift the traditional retirement age for Social Safety, however develop entry to the incapacity security internet so blue-collar staff who can’t do their jobs into their late 60s wouldn’t be penalized.

Peterson, of the Convention Board, stated that it’s unrealistic to resolve the deficit drawback in a decade, however vital to “bend the curve” so deficits come down over 20 to 30 years. She advisable that Congress appoint a blue-ribbon fee to provide you with a plan for deficit discount that might earn bipartisan help. The objective: to scale back federal debt held by the general public from immediately’s 98 p.c to round 70 p.c over the following few many years. In November I wrote about two bipartisan payments to determine fiscal commissions.

Zentner, who grew up in Texas and was thus talking on her house turf, identified that the federal government doesn’t want to begin operating surpluses to make up for years of operating deficits. Because the financial system grows, tax income tends to develop with it, and the prevailing load of debt turns into extra inexpensive. The federal government may even afford to run small deficits and nonetheless develop its approach out of its debt drawback. However she introduced charts displaying that immediately’s deficits are far above what’s sustainable.

Deficits got here up in different periods on the economics convention. James Hines, who teaches on the College of Michigan’s regulation faculty and economics division and serves because the analysis director of the enterprise faculty’s Workplace of Tax Coverage Analysis, stated that by 2029, federal debt held by the general public as a share of G.D.P. will surpass the report set on the finish of World Struggle II. Again then, it shrank rapidly, owing to a postwar financial growth and inflation. This time, it gained’t.

Hines stated he’s not so apprehensive that rising deficits will trigger a disaster. Extra seemingly, he stated, they are going to slowly erode American energy because the nation is pressured to chop again on analysis and improvement, funding and navy spending. “Why is america wealthy to start with?” he requested. It’s as a result of “we’ve been doing capitalism higher than quite a lot of different locations,” he stated. “If we let that erode, you’re beginning to undermine the sources of your wealth.”

Dynan made an identical level. There is no such thing as a threshold for debt above which “hair goes on fireplace,” she stated. She stated she virtually wished there have been, as a result of it’d provoke folks into motion.

Outlook: Tim Duy

The Federal Reserve may minimize rates of interest as aggressively because it raised them, in line with Tim Duy, the chief U.S. economist at SGH Macro Advisors. In his Monday publication, he wrote that when the Federal Reserve chair, Jerome Powell, determined the Fed wanted to lift charges sharply to curb inflation, “he moved rapidly.” Now that inflation seems to be coming below management, the Fed may unwind these will increase simply as rapidly, Duy wrote. “The urgency will solely enhance if the Fed decides it’s chasing low inflation prefer it was chasing excessive inflation two years in the past, or if it perceives a menace to the employment mandate.”

Quote of the Day

“Fifty-six p.c of the economically most impactful applied sciences come from simply two U.S. areas, Silicon Valley and the Northeast Hall.”

— Aakash Kalyani, Nicholas Bloom, Marcela Carvalho, Tarek Hassan, Josh Lerner and Ahmed Tahoun, “The Diffusion of New Applied sciences,” revised working paper (Oct. 30, 2023)