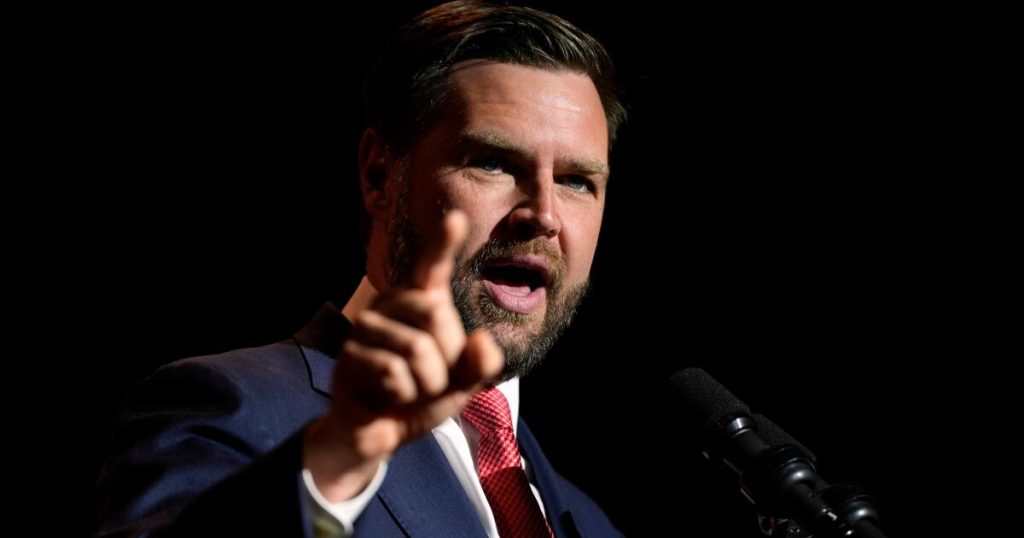

Republican vice presidential nominee JD Vance instructed Megyn Kelly final month that Democrats are calling for an finish to the Little one Tax Credit score as a result of they’re “anti-family and anti-kid.” Vance, who has courted controversy for calling Democrats the occasion of “childless cat girls,” then declared, “We should always ship the sign to the tradition that we’re the pro-family occasion, and we’re gonna again it up with actual coverage. We’re the occasion of fogeys, we’re the occasion of children.”

Republicans are utilizing Vance’s children and households rhetoric to persuade voters to decide on them in November, however they’re failing relating to backing it up. The truth is, they’re actively opposing essential laws to assist kids and oldsters.

On Thursday, Senate Republicans blocked a invoice that may broaden the Little one Tax Credit score — the very coverage that Vance has championed and simply accused Kamala Harris of opposing. Vance didn’t present up for the vote. Killing the proposal was a loss to roughly 16 million kids in low-income working households, who would have benefited from about $700 in tax reduction this 12 months. Estimates from the Heart on Finances and Coverage Priorities present that the proposal would have lifted at the very least 500,000 kids above the poverty line and raised the household incomes for at the very least 5 million extra poor kids.

The Little one Tax Credit score isn’t simply the simplest coverage device for pulling kids out of poverty — it’s additionally probably the most widespread legislative proposals within the nation proper now. The present invoice had bipartisan assist when it handed the Home in a 357-70 vote in January. Polling confirmed that 69% of People supported the proposal, together with 80% of Democrats, 59% of Republicans and 63% of independents. The laws even included tax cuts for some companies’ analysis and growth efforts in addition to investments that Republicans have lengthy sought.

Influential enterprise teams made it clear that they needed the invoice to move. However Republican management was in a position to preserve it from attending to a vote, even with a majority of the Senate in favor, as a result of 60 votes are wanted to interrupt the filibuster.

The massive cause that Republicans killed the Little one Tax Credit score measure seems to have little to do with coverage. Iowa Sen. Charles E. Grassley stated the quiet half out loud in January when he famous that it would “make Biden look good.”

Republicans additionally fought the larger, momentary growth of the Little one Tax Credit score that handed in 2021. That laws was historic, and poverty amongst kids was lowered by 44% to its lowest stage on report whereas it was in impact. However over the last three years, the occasion demonstrated that it’s nonetheless dedicated to an financial program that places tax cuts for giant companies above the well-being of youngsters and households.

On the similar time, the GOP has blocked laws to construct a common pre-Okay system, enact paid household and medical depart, broaden subsidies for baby care and enhance dwelling care for older individuals and other people with disabilities.

Republicans wish to have it each methods, touting their pro-family agenda whereas blocking pro-family laws.

Democrats shouldn’t simply mock Vance’s “childless cat woman” feedback or depend on authorized instances, even felony convictions, to make their case within the closing months of this election marketing campaign. The occasion‘s candidates must make it clear who’s standing up for kids and oldsters.

More and more, Republicans are framing the parenting difficulty as an existential query. Specializing in coverage for kids and households, they argue, demonstrates a dedication to the longer term.

This can be a debate Democrats ought to welcome — and one they will handily win.

Justin Talbot Zorn is a senior advisor on the Heart for Financial and Coverage Analysis. Mark Weisbrot is co-director.