Probably the most elementary fact about buying and selling is that your opponent is YOURSELF. The bulk have to be fallacious as a result of they’re the gas that propels the market. The market enters a flash-type crash when the overwhelming majority is LONG, and so they attempt to promote, however there is no such thing as a bid. Far too many individuals demonize buying and selling comparable to “paper gold,” arguing that it’s not actual. But, remove futures, and also you get liquidity, after which gold’s worth would decline, not rise.

With no frequent trade, gold has no worth. What offers gold any worth is the truth that it’s accepted as having some worth. If you happen to can not decide a price, no commodity, inventory, bond, or object may ever have a price. This can be a barter economic system the place you’ll NOT commerce except you want the merchandise in trade or know with certainty you’ll be able to trade it with a 3rd occasion.

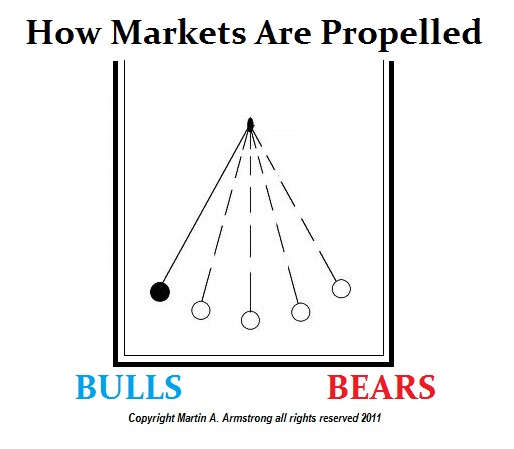

To keep away from getting caught on the excessive or the low, it’s essential to perceive the character of markets and the way they operate. When you accomplish that realization, you will note your actual opponent is YOURSELF, not the grand cabal. The bulk have to be trapped on the excessive, which then creates panic when the bulk tries to promote however there may be no bid. Likewise, on the low, the bulk is bearish, and the dominant commerce is brief. They attempt to purchase again, inflicting a panic to the upside for the shortage of affords. It’s a pendulum swinging to the acute on each side, which propels the market motion.

I’ve said that gold would backside solely after it turned a grimy phrase. All that yelling and screaming about manipulation or no matter commodities at the moment are in an inflatonary pattern. Claims that cash must be tangible would profit the bondholders on the expense of the individuals. Folks at the moment are transferring into commodities as they’ve misplaced belief in authorities and have an instilled concern of the longer term. Gold will rise co-currently with shares amid this wave as individuals search to maneuver cash out of public areas.

Confidence in authorities goes down and gold goes up. Gold is just not fiat. It’s impartial. Inventory rallies imply gold rallies – the 2 are going up as a result of it’s the commerce in opposition to authorities bonds vs the personal sector. You get one thing again even when, say, GM goes bankrupt. You get nothing if the federal government goes bust.

I’m not some guru, wizard, prophet, oracle, or no matter. I’m simply somebody who has been fascinated with understanding how issues work. I exploit quantitative modeling to permit the market to talk its thoughts, and that’s the greatest forecaster you’ll be able to ever think about because the market isn’t fallacious.

For individuals who have just lately joined us, needless to say there’s a large distinction between OPINION and actual FORECASTING. Skilled establishments comply with us for what the pc says, NOT as a result of I personally have by no means been fallacious. Nobody’s OPINION isn’t fallacious. Actual cash will NEVER commerce primarily based upon somebody’s private OPINION. The speaking heads are for retail, not professionals.

A central financial institution really helpful to a really main pension fund referred to as upon me a few years in the past. I spoke to the top and the very first thing out of his mouth: “We shouldn’t have any respect for lecturers. We’re calling you ONLY as a result of the central financial institution needed us to provide you a name, which, in fact, was off the report.” After I responded we weren’t lecturers, had actual administration and buying and selling expertise, and used quantitative fashions, the air was cleared and we started the undertaking. Actual cash doesn’t take heed to OPINION. It simply can not.

I might by no means solicit to promote a consumer one thing. It’s NEVER “I feel,” it’s ALWAYS, “Here’s what the pc is exhibiting on this market or that one.” We correlate the world and present you the connections. This can be a studying expertise; solely then will you could have the braveness of your convictions to beat your self within the buying and selling sport.