QUESTION: Your mannequin has projected a recession into 2028. ZeroHedge publishes “If the whole lot goes to be simply wonderful, why are hundreds of shops closing everywhere in the nation? To this point this yr, the overall quantity of retail house that has been completely closed has surpassed 120 million sq. ft. Now we have by no means seen something like this earlier than. Retailer closings spiked throughout the early days of the pandemic, however in 2025, shops are being completely shuttered at a fair sooner tempo.”

Do you agree with this? You could have additionally written that partly this can be a paradigm shift like Schumpet’s waves of Inventive Destruction. May you handle this paradox?

Ronnie

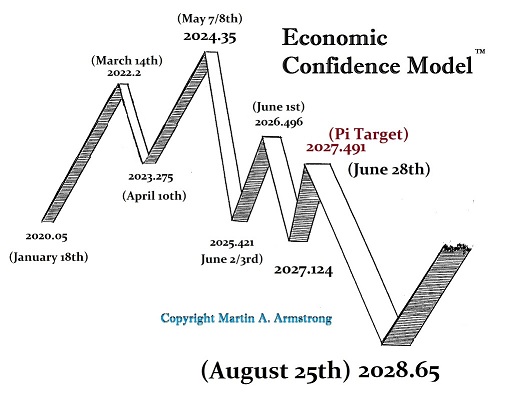

ANSWER: Zero Hedge’s assertion is somewhat deceptive, however actually not intentional. Sure, we’ve got a recessionary pattern globally into 2028, which has additionally been set in movement throughout the EU by the pounding of struggle drums. The EU is extra prone to expertise a DEPRESSION, whereas the USA could have a recessionary environment with STAGFLATION, extra just like the Seventies, with inflation outpacing GDP progress primarily because of rising prices and wars globally.

Our pc is demonstrating that volatility in Unemployment will rise from 2026, peaking first in 2028 with a Panic Cycle in 2029. This additionally confirms our Conflict Cycles for 2026. What we MUST come to grips with is that there’s way more to understanding the economic system from a single statistic perspective. Nevertheless, we’re additionally present process two important elements that the traditional financial fashions fail to include, apart from the truth that 99% of the rhetoric and the financial fashions overlook the leverage within the banking system that creates cash exterior of the Federal Reserve by lending:

TWO SIGNIFICANT FACTORS OMITTED IN CLASSIC ECONOMIC MODELS

(1) a shift to unbiased contractors/freelancers due to COVID, and (2) a wave of Inventive Destruction.

(1) INDEPENDENT CONTRACT:

I stumbled into this difficulty when the Florida Income Division wished to audit our firm. Florida has no earnings tax, so I used to be a bit befuddled. I found they had been auditing to see if we had unbiased contractors or freelancers who would qualify as a full-time worker, and as such, we weren’t accumulating unemployment taxes, and many others. I’ve NEVER had such an audit – EVER!. So I started to research why I used to be being audited for such a problem. It turned out that the COVID-19 pandemic considerably contributed to the rise in unbiased contractors and freelancers.

1. Job Losses & Financial Uncertainty

Many conventional workers had been laid off or furloughed throughout lockdowns, pushing them into gig work or freelancing to make ends meet.

Firms downsized and relied extra on contract employees to cut back long-term labor prices.

2. Distant Work & Digital Acceleration

The shift to distant work made location-independent freelance roles extra viable.

Platforms like Upwork, Fiverr, and TaskRabbit noticed elevated demand for freelance providers (e.g., digital advertising, programming, consulting).

3. Enterprise Variations

Small companies and startups turned to freelancers for flexibility as an alternative of hiring full-time employees.

The “Nice Resignation” led many employees to hunt autonomy, selecting self-employment over conventional jobs.

4. Authorities & Coverage Influences

Stimulus checks and unemployment advantages (e.g., PPP loans, CARES Act) offered short-term help, permitting some to transition into freelancing.

In some states, labor legal guidelines developed to accommodate gig employees (e.g., California’s Prop 22 for ride-share drivers).

Upwork (2021) reported that 59% of freelancers began throughout or after COVID.

MBO Companions (2021) discovered a 34% improve in unbiased contractors within the U.S. in comparison with pre-pandemic ranges.

OECD information confirmed a worldwide rise in gig economic system participation, particularly in supply (e.g., Uber Eats, DoorDash) and distant freelance roles.

Lengthy-Time period Influence:

Whereas some employees returned to conventional jobs post-pandemic, many stayed unbiased because of flexibility, greater earnings potential, and hybrid work tendencies. The shift towards a extra contract-based workforce is probably going right here to remain.

States with Larger Unemployment Than Pre-COVID (Feb 2020)

Nevada

Pre-COVID (Feb 2020): 3.7%

Mid-2024: 5.2% (fluctuating because of slower tourism restoration)

Cause: Heavy reliance on hospitality and leisure sectors.

California

Pre-COVID: 3.9%

Mid-2024: 4.8%

Cause: Tech layoffs, excessive price of dwelling, and slower rebound in leisure/hospitality, unlawful aliens, and the best earnings tax within the nation.

California Revenue Tax – 13.3% (on earnings over $1,000,000)

New York

Pre-COVID: 3.7%

Mid-2024: 4.5%

Cause: Gradual workplace sector restoration (NYC), lowered enterprise journey, and Wall Avenue shifting to Florida.

New York Revenue Tax – 10.9% (on earnings over $25,000,000)

Illinois

Pre-COVID: 3.4%

Mid-2024: 4.4%

Cause: Outmigration, slower manufacturing restoration.

Illinois Revenue Tax – 4.95%

New Jersey

Pre-COVID: 3.3%

Mid-2024: 4.3%

Cause: Lingering results in service sectors, excessive dwelling prices, abusive taxes, excessive environmental rules.

New Jersey Revenue Tax – 10.75% (on earnings over $1,000,000)

Connecticut

Pre-COVID: 3.5%

Mid-2024: 4.2%

Cause: Slower white-collar job restoration, extreme taxation.

Hawaii

Pre-COVID: 2.4%

Mid-2024: 3.8%

Cause: The economic system is extremely depending on Tourism and excessive taxation

Hawaii Revenue Tax – 11.0% (on earnings over $200,000)

States with No Revenue Tax:

Alaska, Florida, Nevada, South Dakota, Tennessee (repealed funding earnings tax in 2021), Texas, Washington (however has a capital positive factors tax over $250,000), Wyoming

States That Have Recovered or Improved

Texas, Florida, Utah, Idaho, and South Carolina have unemployment charges at or beneath pre-pandemic ranges because of sturdy job progress in tech, manufacturing, and migration tendencies.

Distant Work Developments: NYC and San Francisco, greater than the Solar Belt states, have misplaced workplace work. This, partly, has additionally resulted within the business actual property disaster that was a part of the target of the COVID Rip-off to power folks to make money working from home and cease commuting to save lots of the planet.

Migration Shifts: States like Texas and Florida gained employees, whereas some Northeast/Midwest states misplaced inhabitants. That is the Nice Migration from the BLUE to the RED states. I met individuals who moved to Florida as a result of their youngsters had been changing into suicidal within the Blue States as they shut down sports activities, and lots of youngsters thought their goals in life had been over.

Due to that unusual audit that also prices you $25,000 in authorized and accounting charges for one thing we didn’t owe, I started to dig. I discovered that the rise in unbiased contractors and freelancers was a side-effect of COVID, along with the Nice Migration. States had been searching for spare change. I might not have been shocked in the event that they didn’t begin looking out automobiles for cash left within the ashtrays.

(2) Waves of Inventive Destruction:

Concurrently, the plot behind COVID was to create 15-minute cities and have folks make money working from home, nearly ending commuting. What additionally happened was that individuals had been locked down, and as an alternative of procuring and even going out for dinner, they ordered from Amazon and took out from eating places. COVID set in movement a brand new dynamic that the financial fashions are failing to grasp. Unemployment can rise whereas commerce expands. Simply have a look at the sale of Amazon. Previously 10 years, Amazon has expanded by 625%. I do know a man who had a digital camera store. I closed after 30 years as a result of he may now not compete with solely gross sales from Amazon. That is the story nationwide. However COVID was intelligent. The purpose was to save lots of the planet, and that has resulted in a cascade of small shops and even some chains closing shops. Now you could have UBER.EATS, Door Sprint, and many others, to facilitate meals being delivered to you inside minutes. Folks closed workplaces and workers shifted to dwelling, and business actual property goes into disaster liquidation. That is all not a part of a standard recession – it’s a Inventive Destruction Wave the place unemployment rises, however commerce can develop.

My agency grew to become the best paid analyst ever, and we had been an establishment with some people who had a ton of cash. Our stories used to exit of telex, and the price could possibly be as much as $75 in telex charges per report, which might exit 3 instances a day per foreign money. That was why I started opening workplaces world wide so we may carry down the prices for purchasers by sending one set of stories to our London or Asian workplaces and they’d then redistribute it to the purchasers in that area. This would cut back prices from $200,000-$300,000 per shopper simply in communication prices. We had been Western Union’s greatest shopper.

In 1983, the Wall Avenue Journal wrote a chunk that I used to be charging $2,000 an hour for telephone recommendation. The journalist, after speaking to our shopper who agreed to take part of their assessment, advised him that if I charged $10,000 an hour, they’d pay it. He known as me again and was surprised. I used to be advising on a billion-dollar transaction in 1983. $2,000 or $20,000 didn’t make a lot distinction.

By the mid-to-late Nineteen Eighties, fax machines had been a regular workplace equipment, peaking within the Nineties earlier than electronic mail and digital scanning started changing them. We began sending stories out by FAX, and that lowered the communication prices dramatically. So personally, I’ve lived by the know-how cycle and noticed the worth of transmitting a report from $75 to electronic mail, which is now principally free. That took the enterprise away from Western Union, and has been a wave of Inventive Destruction.

When the East and West Coasts had been linked by practice in 1869, the Railroad period put out of enterprise the wagon practice trade. The US expanded and as practice tracts had been laid across the nation, it was first the Railroad Increase which actually got here to an finish with the Panic of 1907.

The Industrial Revolution expanded, and the Industrialists, led by the auto shares, drove the 1929 growth. The invention of the combustion engine led to tractors for farmers disproving the theories of Malthus that humanity would starve as inhabitants elevated. He by no means understood the cycles of know-how. As farmers had tracked tractors, manufacturing elevated whereas employment declined.

The horse & buggy was changed with vehicles. As they expanded, so did the suburbs develop. Immediately, folks may dwell in locations with out trains. The city I grew up in flourished as a result of we had a practice station, which enabled folks to purchase land and transfer out of the cities. The city I grew up in expanded farther from the practice station with the car.

The primary business airline was the St. Petersburg–Tampa Airboat Line, which started operations on January 1, 1914. They flew a Benoist XIV, a small flying boat (seaplane). The space was solely 23 miles (37KM). It lowered the journey time from 2+ hours by boat or automobile to only 23 minutes.

Subsequently, whereas the ECM has turned down, a majority of these forecasts that concentrate on one side are all the time unsuitable. Economists omitted from their fashions not solely the creation of cash however the banking sector by lending cash, which leverages the cash provide. Those that imagine shutting down the Fed and handing cash creation to the Treasury will remedy inflation have no idea their financial historical past. The invention of gold within the New World flooded Europe and resulted in large inflation. throughout the Fifteenth-Sixteenth centuries. The gold-silver ratio has all the time fluctuated as a result of the invention of silver relative to gold has by no means been confined concurrently.

The huge gold discoveries in California, Australia, and Alaska created waves of inflation. Simply because gold is cash does NOT eradicate inflation. All of the nonsense oh paper foreign money is FIAT and that’s the drawback, is simply silly sophistry. It has NEVER mattered what the cash is from gold, cowrie shells in China, to sheep skins, Bronze, or cattle.

Belongings rise in worth no matter what the cash is perhaps, and the buying energy of cash declines even when it has been gold. That is the enterprise cycle that DID NOT merely seem when paper cash began within the USA.

The financial fashions are DOMESTIC as a result of economists need a job to advise governments that they’re omnipotent in the event that they take heed to them. I’m sorry. As a dealer, you lose your shirt, pants, your home, and your loved ones for those who commerce based mostly on financial theories. They’re totally ineffective. They by no means take into account exterior elements.

(1) All banks create cash with loans (I deposit $100 they usually lend you $100, and each our accounts mirror a cash provide of $100)

(2) They’ve by no means been capable of account for sudden will increase within the cash provide which have been attributable to:

(a) new gold or silver discovery

(b) A struggle in one other area diverted capital searching for shelter as European cash flowed to the US for WWI & WWII

(c) Capital focus the place overseas capital sees a revenue in one other economic system pushed by foreign money values

(d) Capital flight out of your economic system based mostly upon a sudden collapse in confidence, be it mismanagement or struggle

(3) Financial technological evolution (trains, automobiles, airplanes, web, and many others…)

This isn’t even an entire checklist. I solely met one tutorial who thought out of the field, and that was Milton Friedman. Milton got here to take heed to me at a buying and selling conference in Chicago. I used to be explaining capital flows and currencies. After I was completed, Milton stepped ahead to shake my hand and mentioned I used to be doing what he had solely dreamed about. We grew to become buddies, after which I understood what he was speaking about. He had theories {that a} floating trade charge system would impose checks and balances upon the fiscal insurance policies of the federal government. He had written that concept down in 1953.

Whereas I defined the Nice Despair and the Sovereign Debt Defaults in 1931 in Europe, even Canada suspended debt funds, you possibly can see the capital was taken again to its dwelling international locations, ending the Roaring ’20s. Everybody politically blamed Hoover after which tariffs, however no person understood worldwide capital flows.

I defined HOW the G5 deliberately lowered the worth of the greenback by 40% to cut back the commerce deficit. As idiots, they by no means understood that doing meaning you had been devaluing the whole lot held by a foreigner. Japan owned as much as 30% of the US Nationwide Debt, they usually dumped it because the capital flows revealed.

It was World Conflict I and World Conflict II that made the US the monetary capital of the world as a result of all of the gold fled to the USA throughout the wars. There was ABSOLUTELY no political determination made by any home politician that stood up and proposed making the US turn out to be the brand new capital for finance, taking that title from Britain.

There’s completely no historic proof that repeated struggle have ever benefited any nation. Conflict destroys the economic system, as evidenced by Lydia, which invented coinage and fought Persia. Athens grew to become the monetary capital of the world after the Battle of Marathon, they usually had been compelled to debase and misplaced within the Peloponnesian Conflict to Sparta.

The favourite section in economics is: “Assuming all issues stay equal.” After all, that by no means occurs.

Now we have the socialists all the time claiming the issue is wealth disparity. They hate individuals who have greater than they do – that’s all. Each China and Russia tried Marxism’s wealth disparity answer – confiscate all personal wealth to create materials equality. The folks realized that you simply had no proper to be particular person. When everybody was equal, they usually wanted a flooring swept, you had been subsequent in line – right here is your broom.