Warner Bros. Discovery linear networks continued to lose floor amid ongoing challenges, weighing on the fourth quarter.

Income eased 1% to $10 billion, shy of Wall Avenue forecasts. Internet Some $1.9 billion fees together with restructuring expense hit the underside line as the corporate swung noticed a $640 million loss for the final three months of 2024.

Streaming added 6.4 million subscribers pushing Max whole world subs to 116.9 million.

Networks, WBD’s greatest phase, noticed income dip 5% to $4.8 billion and income down 13% to $1.9 billion. Advert income dropped 17%, pushed by home networks viewers declines of 28% and the persevering with softness within the home linear promoting market. Distribution income eased 5%. Income from content material jumped.

Media corporations are transitioning to linear and WBD could also be rushing up the method in a company restructuring to take impact later this yr that many consider will finally result in splitting off its cable networks, very similar to Comcast is planning to do.

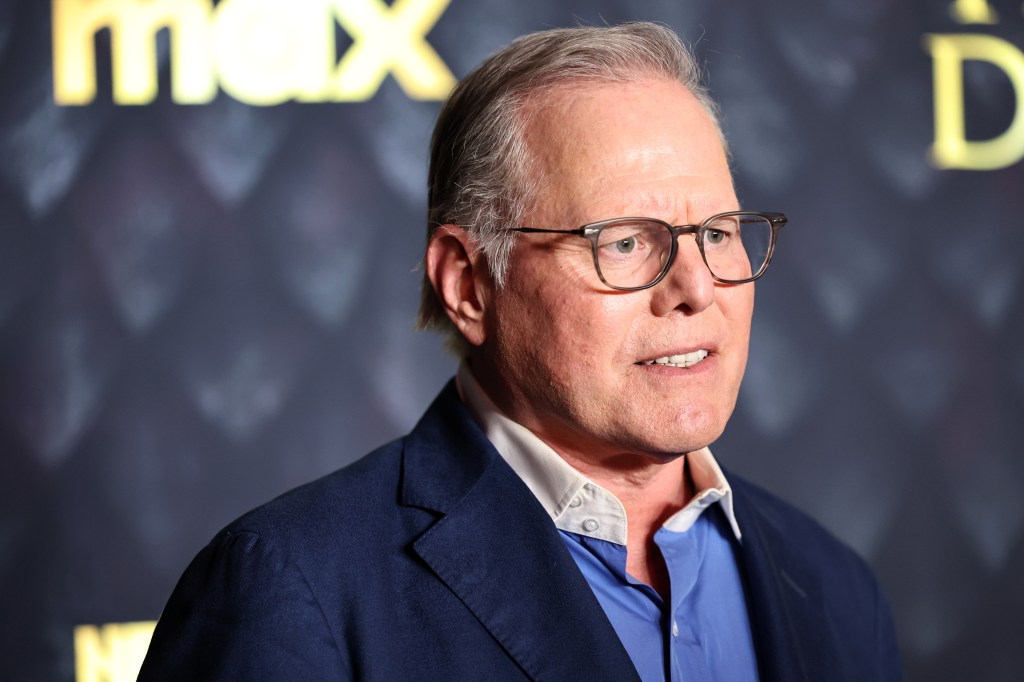

CEO David Zaslav can be presiding over a name with analyst at 8 am ET

Studio income rose 16% to $3.7 billion pushed by TV, which jumped 64% on inner licensing agreements and better preliminary telecast deliveries, which had been impacted by the WGA and SAG-AFTRA strikes within the prior yr.

Theatrical income decreased 9% on fewer releases.

The bugaboo of video games noticed income plunged 29%

DTC income rose 5% to $2.7 billion and the phase swung to a $409 million revenue from a $55 million loss. Advert income rose 27%. Content material income decreased 40% as a consequence of fewer third-party licensing offers.