Enterprise reporter

CCTV

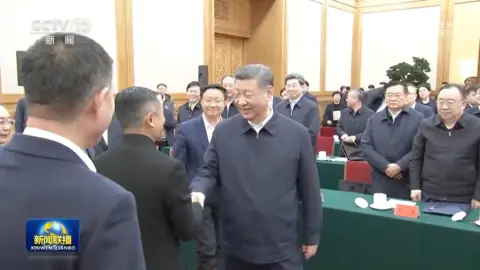

CCTVA gathering between Chinese language president Xi Jinping and among the nation’s foremost enterprise leaders this week has fuelled pleasure and hypothesis, after Alibaba founder Jack Ma was pictured on the occasion.

The charismatic and vibrant Mr Ma, who was certainly one of China’s most distinguished businessmen, had withdrawn from public life after criticising China’s monetary sector in 2020.

His reappearance at Monday’s occasion has sparked a wave of dialogue, with specialists and analysts questioning what it means for him, China’s tech sector and the financial system basically.

The response has been overwhelmingly optimistic – tech shares, together with these of Alibaba, rallied quickly after the occasion.

On Thursday, the e-commerce big reported monetary outcomes that beat expectations, with shares ending the buying and selling day in New York greater than 8% larger. The corporate’s shares are up 60% for the reason that starting of the yr.

So what are analysts studying into Mr Ma’s look on the occasion alongside different high-profile company – together with DeepSeek founder Liang Wenfeng?

Is Jack Ma ‘rehabilitated’?

Analysts started on the lookout for clues concerning the significance of the assembly as quickly as Chinese language state media began releasing photos of the occasion.

“Jack Ma’s attendance, his seating within the entrance row, despite the fact that he didn’t communicate, and his handshake with Xi are clear indicators he has been rehabilitated,” China analyst Invoice Bishop wrote.

Social media was abuzz with customers praising Mr Ma for his return to the general public highlight.

“Congratulations [Jack] Ma for the secure touchdown,” mentioned one consumer on Chinese language social media platform Weibo.

“The comeback of [Jack] Ma is a shot within the arm to the present Chinese language financial system,” mentioned one other.

It’s unsurprising that observers have connected a lot significance to an look by Mr Ma.

Earlier than his disappearance from public life in 2020 – following feedback at a monetary convention that China’s state-owned banks had a “pawn-shop mentality” – Mr Ma was the poster boy for China’s tech business.

Reuters

ReutersAn English trainer with no background in computing, Mr Ma co-founded Alibaba in his residence greater than twenty years in the past after convincing a bunch of pals to spend money on his on-line market.

He went on to construct certainly one of China’s largest tech conglomerates and develop into one of many nation’s richest males.

That was earlier than his “pawn store” remark, when he additionally lamented the “lack of innovation” within the nation’s banks.

It led to the cancellation of his $34.5bn (£27.4bn) inventory market flotation of Ant Group, his monetary expertise big.

This was seen on the time as an try by Beijing to humble an organization that had develop into too highly effective, and a frontrunner who had develop into too outspoken.

Analysts agree that the very fact he is again within the highlight, at a symposium the place Xi Jinping himself presided, is an excellent signal for Mr Ma.

Some warning, nevertheless, that the very fact he was not among the many audio system might present that he has not totally returned to the exalted standing he as soon as loved.

Additionally, the shortage of protection his attendance obtained in Chinese language media retailers appears to verify he has not been utterly rehabilitated.

Is the crackdown on the tech business over?

Xi Jinping instructed individuals on the symposium that their firms wanted to innovate, develop and stay assured regardless of China’s financial challenges, which he described as “momentary” and “localised”.

He additionally mentioned it was the “proper time for personal enterprises and personal entrepreneurs to totally show their skills”.

This has been extensively interpreted as the federal government telling personal tech companies that they too are again in good graces.

Mr Ma’s downfall had preceded a broader crackdown on China’s tech business.

Corporations got here to face a lot tighter enforcement of knowledge safety and competitors guidelines, in addition to state management over necessary digital property.

Different firms throughout the personal sector, starting from training to actual property, additionally ended up being focused in what got here to be often known as the “widespread prosperity” marketing campaign.

The measures put in place by the widespread prosperity insurance policies had been seen by some as a approach to rein within the billionaire homeowners of a few of China’s largest firms, to as an alternative give prospects and staff extra of a say in how companies function and distribute their earnings.

However as Beijing imposed robust new laws, billions of {dollars} had been wiped off the worth of a few of these firms – a lot of them tech companies – rattling worldwide traders.

This, together with a worsening international financial system that was affected by the pandemic in addition to Russia’s invasion of Ukraine, has contributed to appreciable adjustments in China’s financial state of affairs.

Progress has slowed, jobs for the nation’s youth have develop into extra scarce and, amid a property sector downturn, individuals are not spending sufficient.

As rumours that Mr Ma would attend Monday’s assembly started to unfold, so did a glimmer of hope. Richard Windsor, director of expertise at analysis agency Counterpoint, mentioned Mr Ma’s presence could be an indication that China’s management “had sufficient of stagnation and may very well be ready to let the personal sector have a a lot freer hand”.

Except for Mr Ma and Mr Liang, the checklist of company additionally included key figures from firms resembling telecommunications and smartphone agency Huawei, electric-vehicle (EV) big BYD, and plenty of others from throughout the tech and industrial sectors.

“The [guest] checklist showcased the significance of web/tech/AI/EV sectors given their illustration of innovation and achievement,” mentioned a be aware from market analysts at Citi.

“[It] doubtless signifies the significance of expertise… and the contribution of personal enterprises to the event and progress of China’s financial system.”

These current on the assembly appeared to share that sentiment. Lei Jun, the chief government of shopper electronics big Xiaomi, instructed state media that he senses the president’s “care and help” for companies.

Is it due to US sanctions?

The symposium happened after the nation skilled what some observers have described as a “Sputnik second”: the arrival of DeepSeek’s disruptive R1 synthetic intelligence (AI) mannequin on the finish of final month.

Quickly after its launch, the Chinese language-made AI chatbot rose by means of the ranks to develop into some of the downloaded on the planet. It additionally triggered a sudden sell-off of main US tech shares, as fears mounted over America’s management within the sector.

Again in China, the app’s international success has sparked a wave of nationwide satisfaction that has shortly unfold to monetary markets. Funding has been pouring into Chinese language shares – notably these of tech firms – listed in Hong Kong and mainland China.

Funding banking big Goldman Sachs has additionally upgraded its outlook for Chinese language shares, saying speedy AI adoption may increase firms’ revenues and entice as a lot as $200bn of funding.

However the largest significance of this innovation was that it got here on account of DeepSeek having to innovate because of a ban on the export of superior chips and expertise to China.

Xinhua

XinhuaNow, with Trump again within the White Home and his fondness of commerce tariffs, Mr Xi might have discovered it essential to recalibrate his method to China’s entrepreneurs.

As an alternative of a return to an period of unregulated progress, some analysts imagine Monday’s assembly signalled an try to steer traders and companies towards Mr Xi’s nationwide priorities.

The Chinese language president has been more and more emphasising insurance policies that the federal government has known as “high-quality improvement” and “new productive forces”.

Such concepts have been used to replicate a swap from what had been beforehand quick drivers of progress, resembling property and infrastructure funding, in the direction of high-end industries resembling semiconductors, clear vitality and AI.

The objective is to realize “socialist modernisation” by 2035 – larger residing requirements for everybody, and an financial system pushed by superior manufacturing and fewer reliant on imports of overseas expertise.

Mr Xi is aware of that to get there he’ll want the personal sector totally on board.

“Moderately than marking the top of tech sector scrutiny, [Jack Ma’s] reappearance means that Beijing is pivoting from crackdowns to managed engagement,” an affiliate professor on the College of Know-how Sydney, Marina Zhang instructed the BBC.

“Whereas the personal sector stays a vital pillar of China’s financial ambitions, it should align with nationwide priorities – together with self-reliance in key applied sciences and strategic industries.”