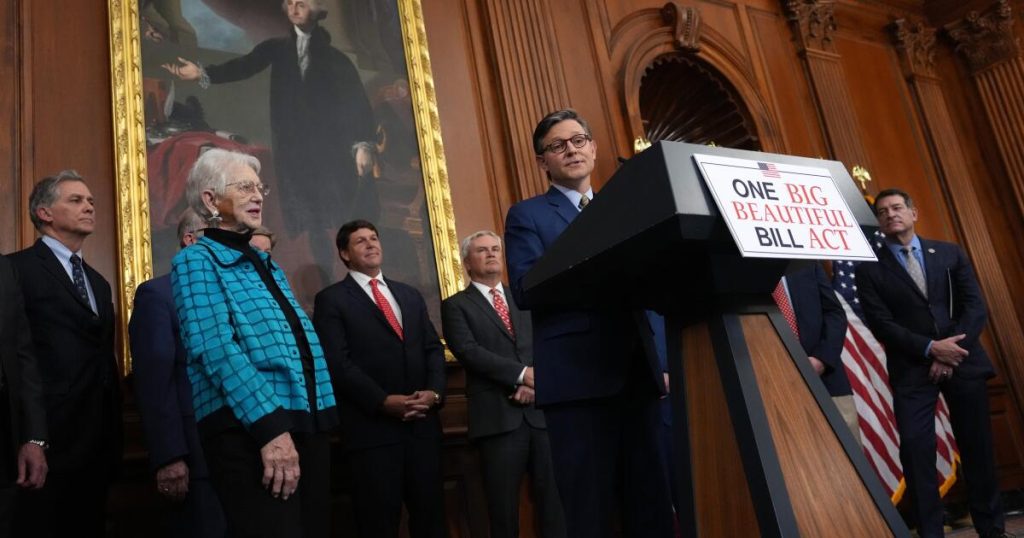

Because the Senate takes up the “One Large Stunning Invoice” (Donald Trump’s identify for it) handed by the Home final week, there’s lastly some dialogue of the nationwide debt. That’s as a result of the invoice is estimated so as to add $3.8 trillion over the subsequent decade to the present debt: $37 trillion, or greater than 120% of U.S. GDP.

The bond markets have been shouting their disapproval. Bond buyers are demanding larger yields as a result of they’re beginning to doubt that we may be trusted to repay our obligations. Curiosity on the debt in fiscal yr 2025 will exceed spending on protection, Medicare and Medicaid. By 2035, it’s projected to overhaul every thing however Social Safety.

Relatively than indulge within the normal punditry about Republican and Democratic hypocrisy and spending misfeasance, I need to pull again the lens a bit. We will’t let Congress off the hook, nevertheless it’s value asking whether or not our issues are extra structural than the Washington-centric story about cowardly politicians suggests.

The phrase “demography is future” is overused and abused, however there’s some fact to it. Think about Thomas Malthus. In “An Essay on the Precept of Inhabitants” (1798), the pioneering economist recognized what got here to be often called the “Malthusian entice.” In affluent occasions, inhabitants grows geometrically however meals provides enhance solely arithmetically. Extra infants result in fewer assets per individual, ultimately inflicting a inhabitants crash. Malthus will get a nasty rap as a result of he was broadly proper retrospectively however profoundly flawed prospectively. In different phrases, he supplied a serviceable rule of thumb about how demographics and economics had labored for 1000’s of years on the exact second that rule was hitting its expiration date. Since 1800, people have found out easy methods to enhance meals provides to far outpace will increase in inhabitants.

However in case you had been a policymaker in 1800, you’d have been a idiot to not take Malthus significantly. The issue at this time, in contrast to in 1800, is that we’re in uncharted territory in relation to the population-and-resources calculation. No society has gotten so wealthy and so previous amid such a crash in fertility charges as ours. And whereas our debt is pushed by many components, it’s the price of entitlements, notably for the aged, that’s by far probably the most severe throughout a lot of the wealthy world.

In 1940, when retirees first began receiving Social Safety advantages, there have been 42 staff per recipient. At this time there are about 2.7 staff for each Social Safety beneficiary. In Japan, the oldest nation on the earth (the place debt is above 255% of GDP), the quantity is 2.1. This pattern applies throughout the developed world.

The first causes for it are fairly easy: We’re making fewer infants and previous persons are dwelling loads longer. In 1940, life expectancy at start for American males was 61.4; for girls it was 65.7. In the event you made it to 65, most individuals had a few dozen years left. At this time life expectancy at start is shut to 80. Not solely do extra folks attain 65, however once they do, additionally they can anticipate to dwell almost 20 extra years.

Oh and opposite to plenty of political rhetoric about how Social Safety funds are merely “your cash” paid in to the system by you over a lifetime; a majority of beneficiaries obtain way more than they paid in.

The “dependency entice,” as economists and demographers name it, is the last word First World downside. And it’s a profound problem, notably for democracies. Outdated folks vote. The largest voting bloc in America is folks over 65: 7 out of 10 of them vote, and so they vote their financial pursuits.

After all, the imbalance between staff paying in and retirees isn’t only a problem due to Social Safety, nevertheless it’s telling that Social Safety is the one program that’s so costly that it’ll proceed to outpace curiosity funds on the debt if present traits maintain — one cause why it’s projected to be bancrupt in eight years. Medicare, the old-age healthcare program, is projected to be bancrupt in 11 years. This leaves out the large personal prices of an growing older inhabitants. Many households spend huge sums on the final years of their mother and father’ lives.

Once more, we don’t know the way this may finish as a result of societies haven’t been right here earlier than. But when we do nothing, some form of debt disaster appears inevitable. There are issues politicians might do to mitigate the worst-case eventualities. Each the U.S. and Germany have incentivized later retirement to assist mitigate the issue. However I for one don’t discover a lot consolation in the concept our present politicians will all of a sudden discover the knowledge and braveness required to do far more.

One other supply for hope is identical one which ended up rendering Malthusianism moot: technological innovation. Medical breakthroughs might make previous age extra reasonably priced. Synthetic intelligence might enhance productiveness to make the worker-per-retiree burden lighter. Giant-scale immigration would quickly have the same impact.

However probably the most indispensable prerequisite for coping with the debt downside can be for voters to care about it. Alas, I don’t see a lot hope for that both.

Insights

L.A. Instances Insights delivers AI-generated evaluation on Voices content material to supply all factors of view. Insights doesn’t seem on any information articles.

Viewpoint

Views

The next AI-generated content material is powered by Perplexity. The Los Angeles Instances editorial workers doesn’t create or edit the content material.

Concepts expressed within the piece

- The article argues that the U.S. nationwide debt disaster is pushed by structural demographic challenges, notably an growing older inhabitants and declining fertility charges, slightly than solely political failures. With entitlement packages like Social Safety and Medicare going through insolvency inside a decade, the worker-to-retiree ratio has plummeted from 42:1 in 1940 to 2.7:1 at this time, exacerbating fiscal pressure.

- Rising life expectancy and growing prices of elder care are compounding the debt burden, as retirees now dwell almost 20 years previous 65 and obtain extra in advantages than they paid into the system. This “dependency entice” is amplified by older voters prioritizing entitlement protections, creating political gridlock.

- Whereas options like delayed retirement, technological innovation, and immigration might mitigate the disaster, the creator expresses skepticism about political will or public demand for reform, suggesting a debt disaster is inevitable with out systemic adjustments.

Completely different views on the subject

- Critics argue that the debt-to-GDP ratio, projected to achieve 128% by 2027[1][2], displays coverage decisions slightly than unavoidable demographic traits. For instance, latest laws just like the “Large Stunning Invoice” provides $3.8 trillion to the debt, highlighting Congress’s function in accelerating fiscal challenges[4].

- Some economists emphasize that technological developments and AI-driven productiveness positive factors might offset demographic pressures, lowering reliance on conventional worker-retiree ratios. The CBO tasks deficits shrinking from 6.2% to five.2% of GDP by 2027, suggesting manageable near-term traits[3].

- Opponents contend that framing the debt as a demographic inevitability dangers absolving policymakers of accountability. The fast debt development—$1.66 trillion previously yr alone[5]—underscores the urgency of bipartisan reforms to entitlements and income, slightly than resignation to structural forces[4][5].